Fiscal Policy Report

- Dec. 2025

Contributors

Mark Blyth

Professor of International Economics & Professor of International and Public Affairs, Brown University

Willem Buiter

Former Member of the Monetary Policy Committee of the Bank of England, Global Chief Economist at Citigroup, & Professor at the LSE

Igor Luksic

Former Prime Minister, Finance Minister, & Foreign Minister of Montenegro

Raymond Ojserkis

Lecturer of History, Rutgers University

Francesco Brindisi

New York City Executive Deputy Comptroller for Accountancy, Budget, & Public Finance

Robert Guttmann

Professor of Economics, Hofstra University

Policy-makers seeking further fiscal policy insights & c-suiters who would like to join our future summits can get in touch here.

Introduction

The State of the Union Working Group on Fiscal Policy convened on December 2, 2025 to review the fiscal position of the United States Federal Government (FG, hereafter).

Six members of the Working Group met under Chatham House rules.

The Group’s membership is comprised of policy-makers and economists across the political spectrum with Keynesian & Austrian, left & right perspectives represented.

This report summarises the areas of consensus, disagreement, and concern amongst members of the Working Group.

- - - - - - -

Executive Summary

There was a unanimous consensus amongst the six contributors - across left and right political persuasions - that the fiscal position of the U.S. federal government is cause for concern and is on an unsustainable trajectory.

There was a unanimous consensus that a policy error could trigger a crisis in the U.S. Treasury market which exposes the fragility of the federal fiscal position.

There was a unanimous consensus that the federal debt ceiling should be abolished.

Of the five members who gave a view on the issue, all expressed concern that growing federal interest payments and debt issuance could eventually crowd out private sector investment.

There was a four to two majority in opposition to the ‘government as household’ analogy as being used in the public discourse on fiscal policy, with the dissenting two members viewing it as imperfect but at times helpful.

There was a unanimous consensus that raising the ages of qualification for federal retirement benefits could play a part in alleviating the fiscal burden on the federal government.

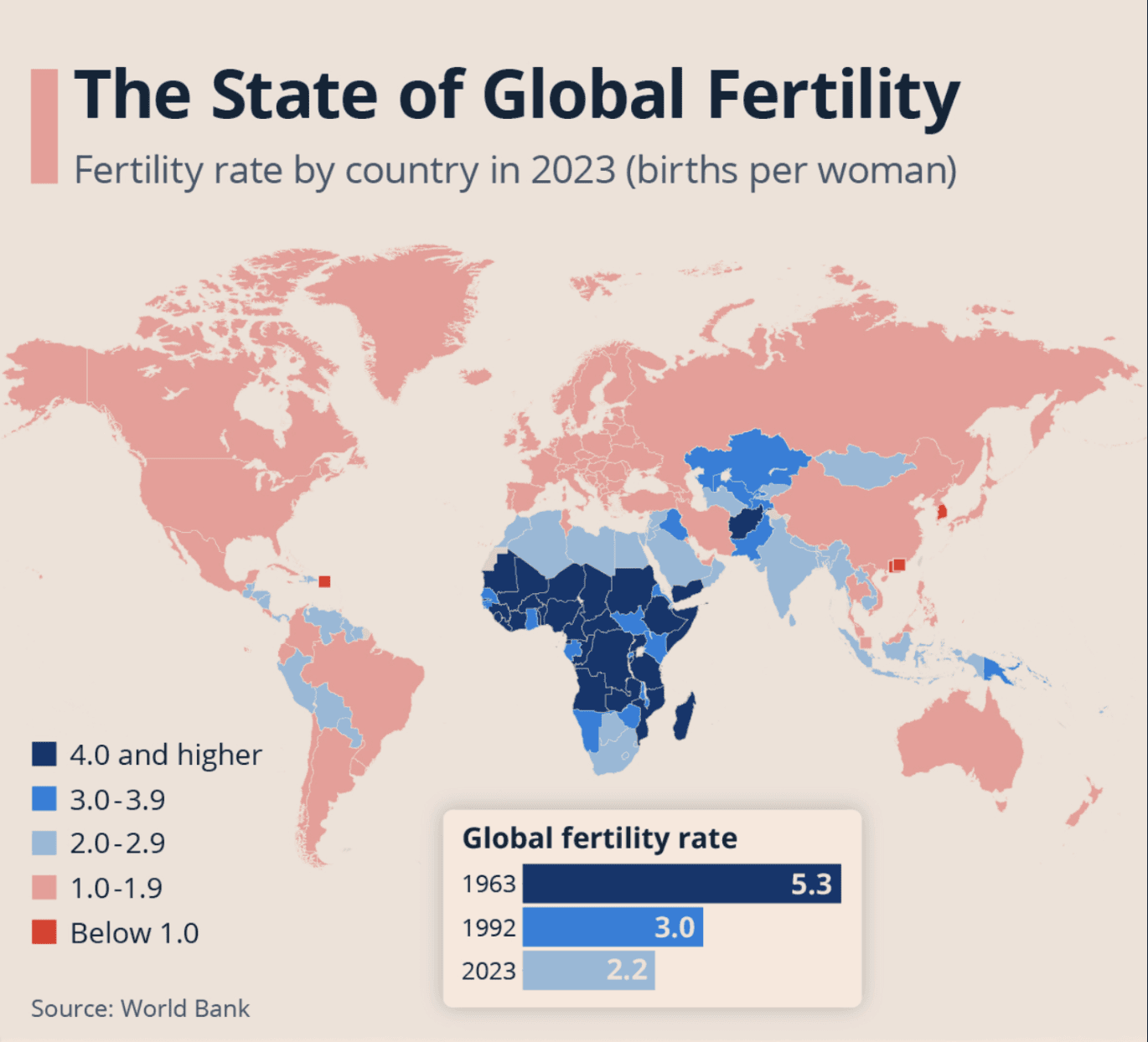

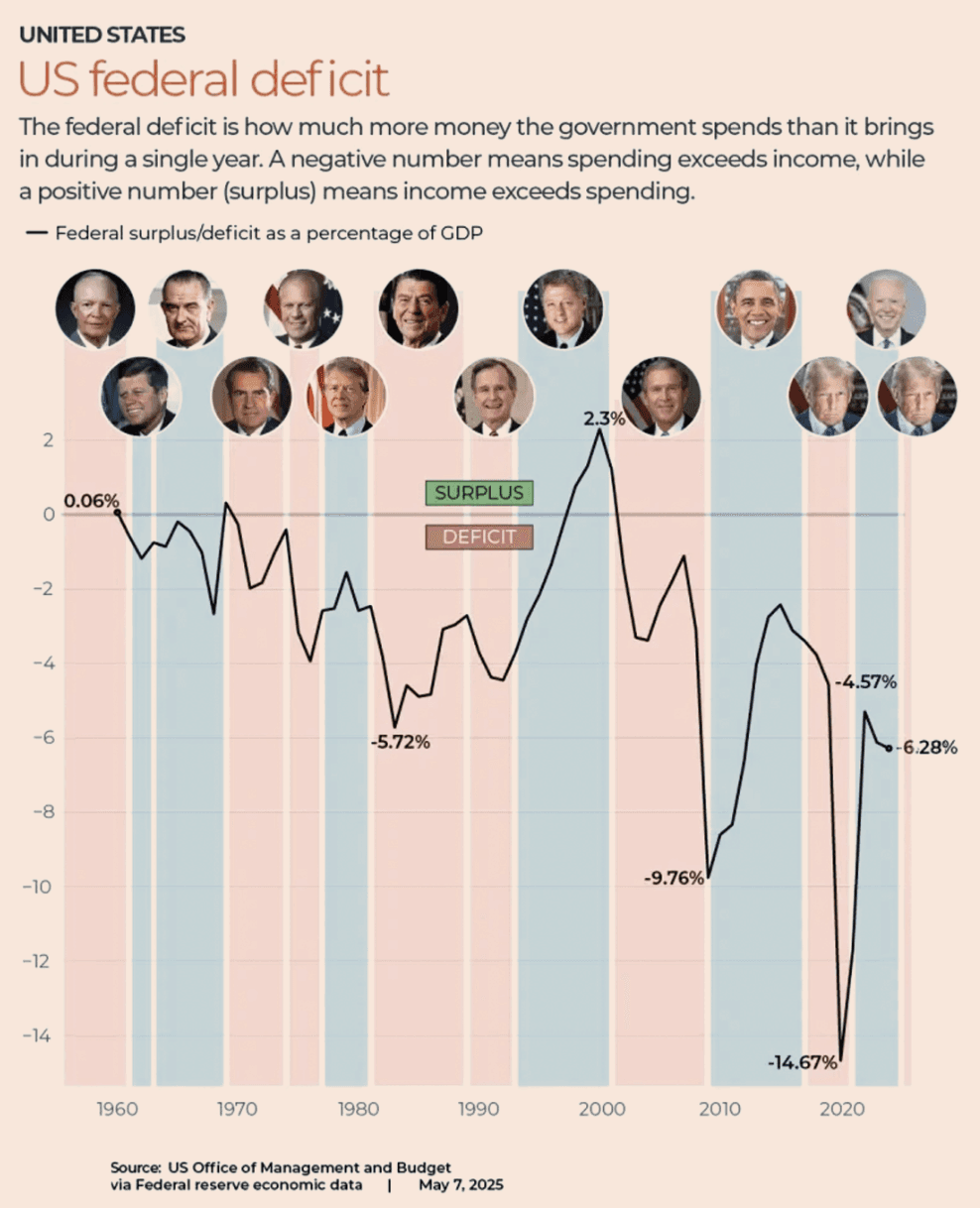

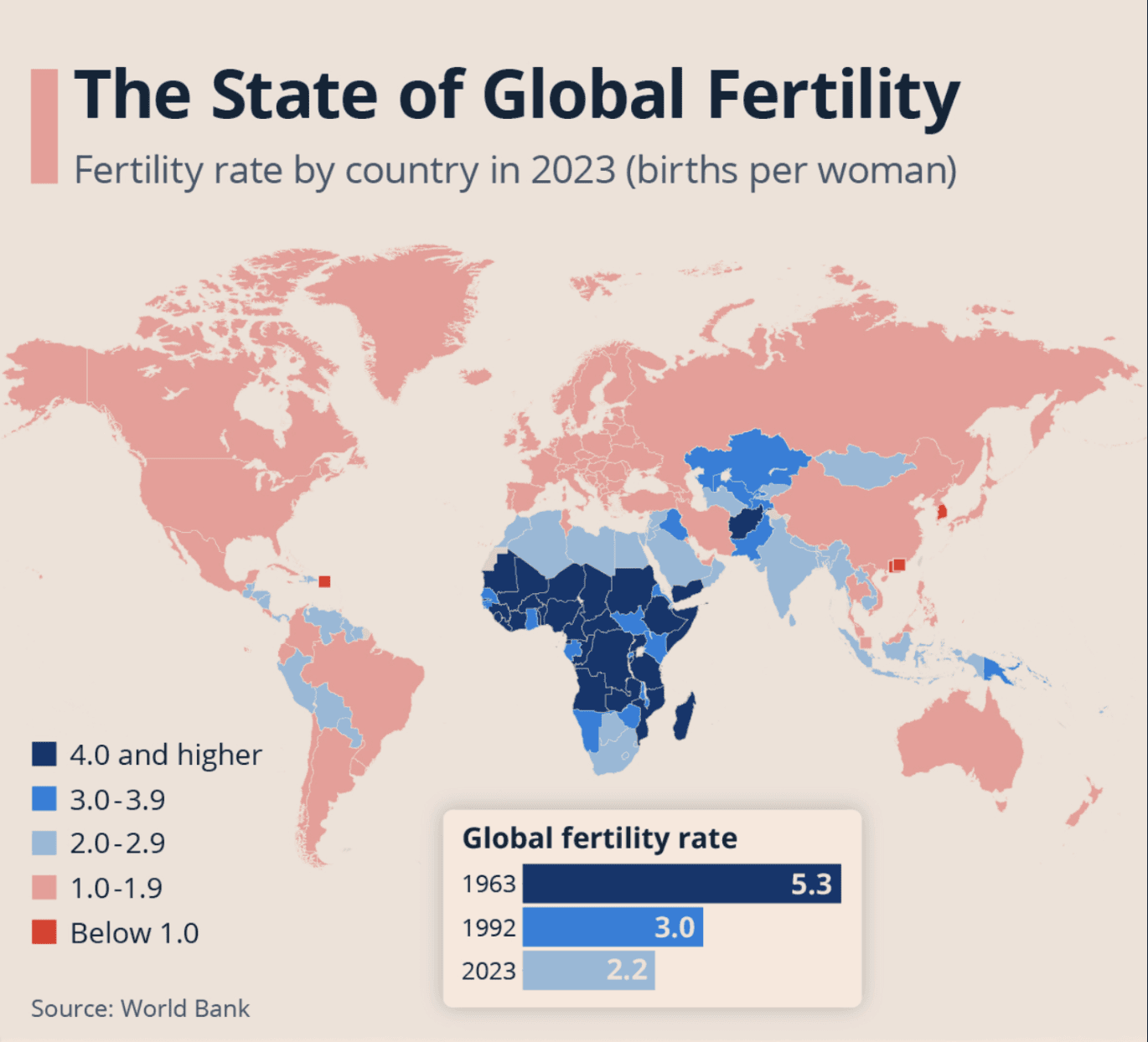

There was a unanimous consensus that declining fertility rates and the demographic challenges they are expected to engender will have significant implications for the federal fiscal position - though it remains unclear how all the second and third order effects of these changes will impact the fiscal trajectory.

Of the five members who expressed a view on the issue, all believe that future environmental challenges will place additional strain on the FG’s fiscal position.

- - - - - - -

Severity of the Fiscal Situation

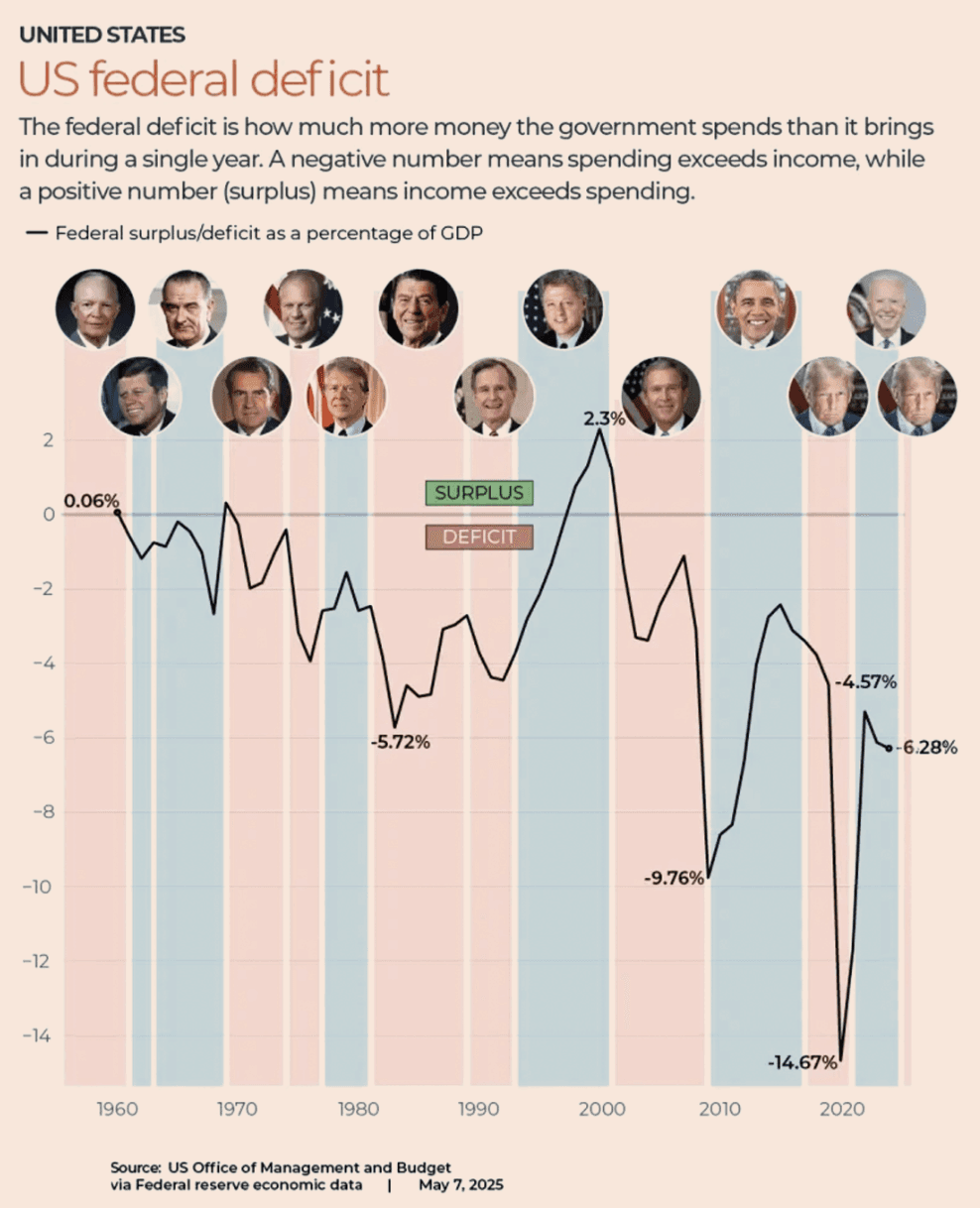

The Group was asked how concerned it is about the fiscal position of the federal government. All six members expressed concern about the current trajectory of the FG’s debt.

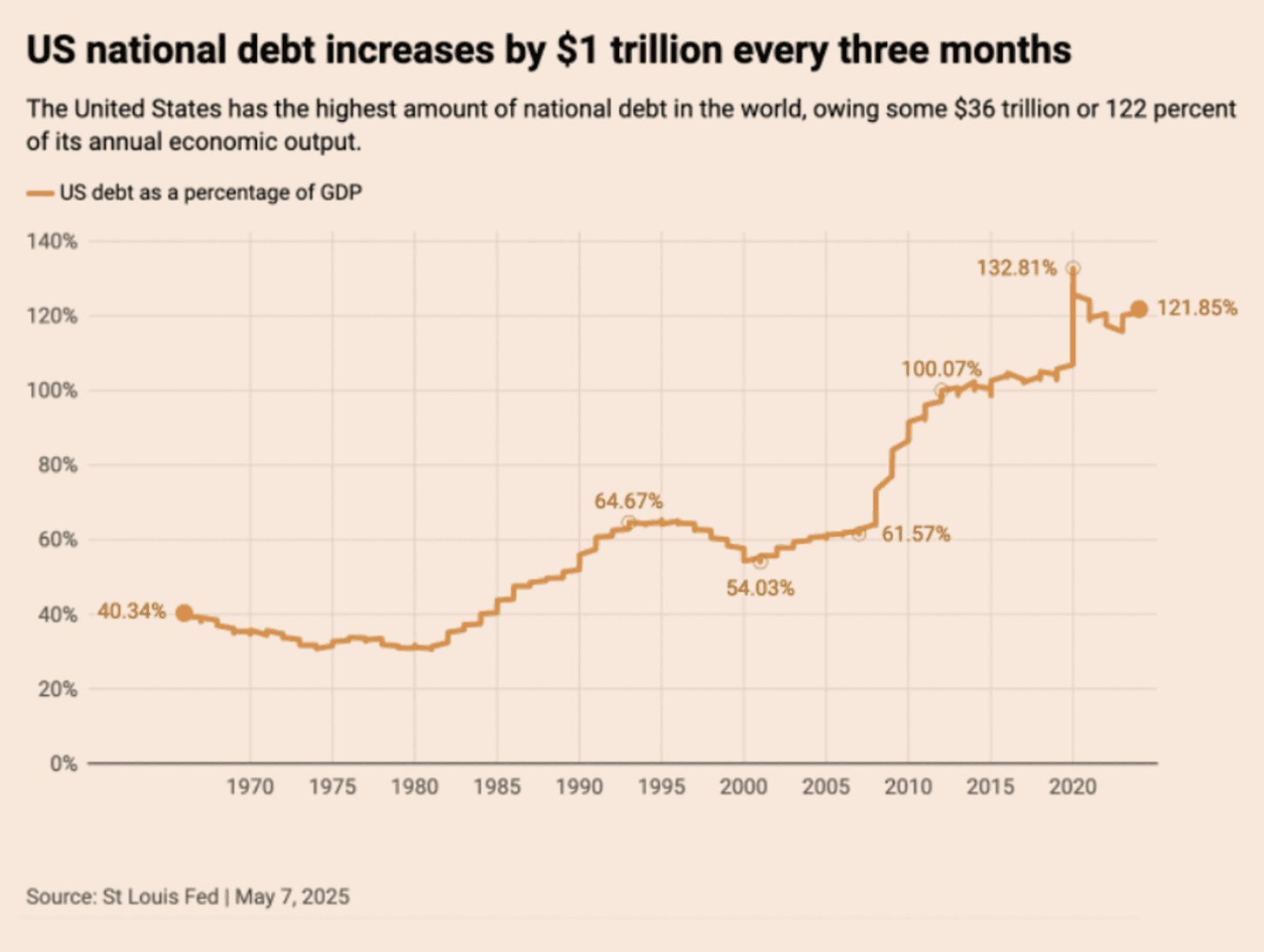

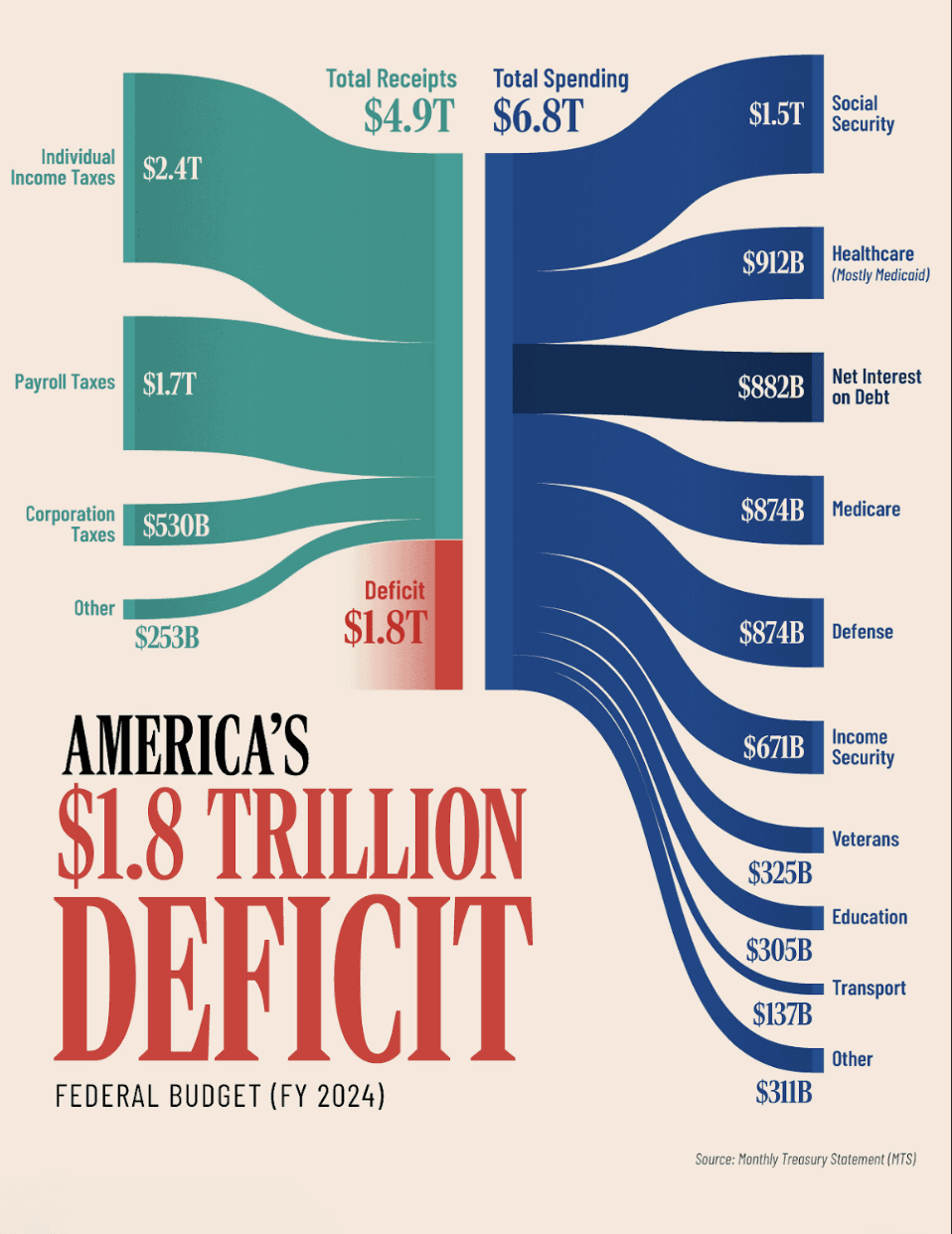

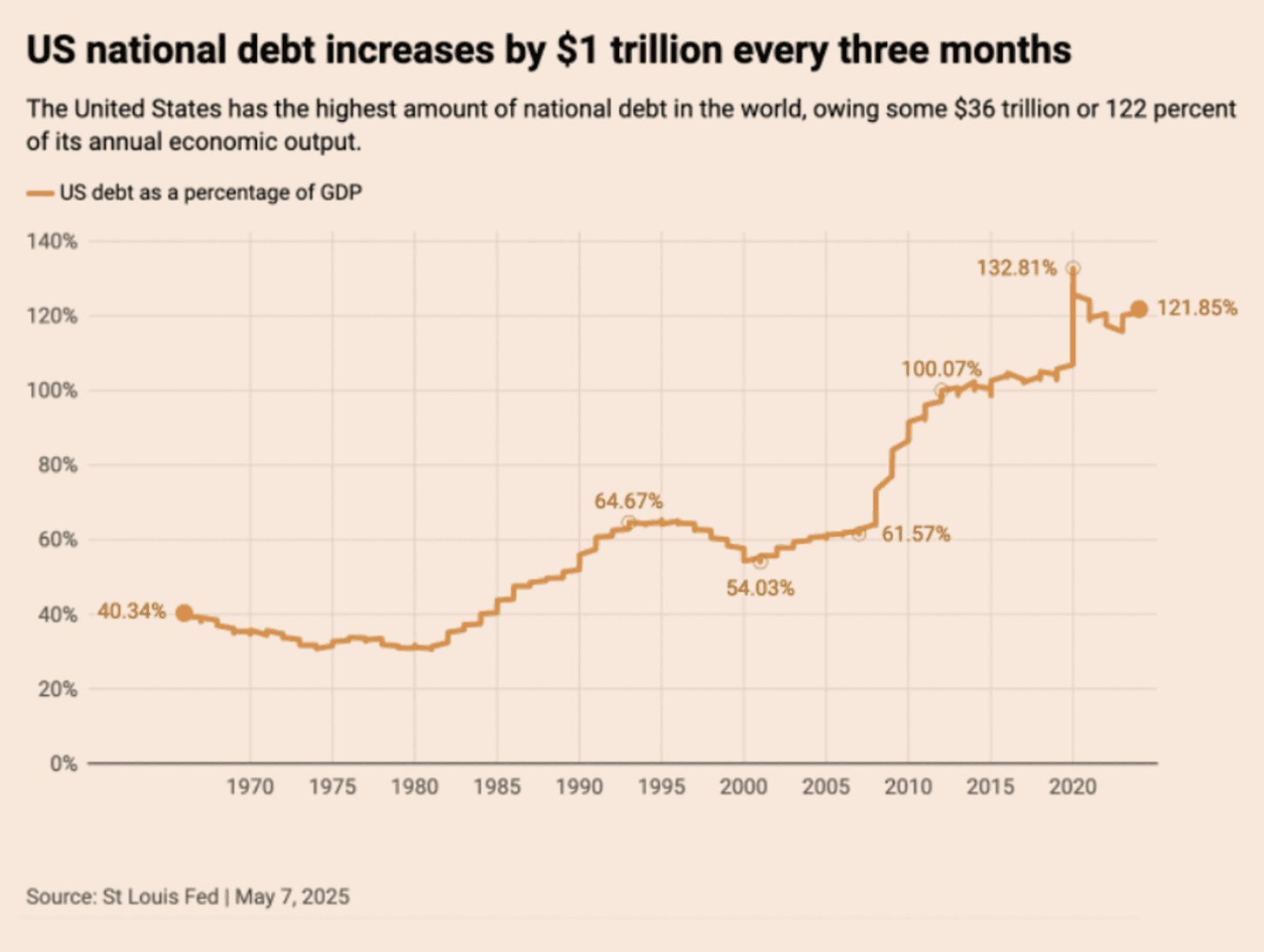

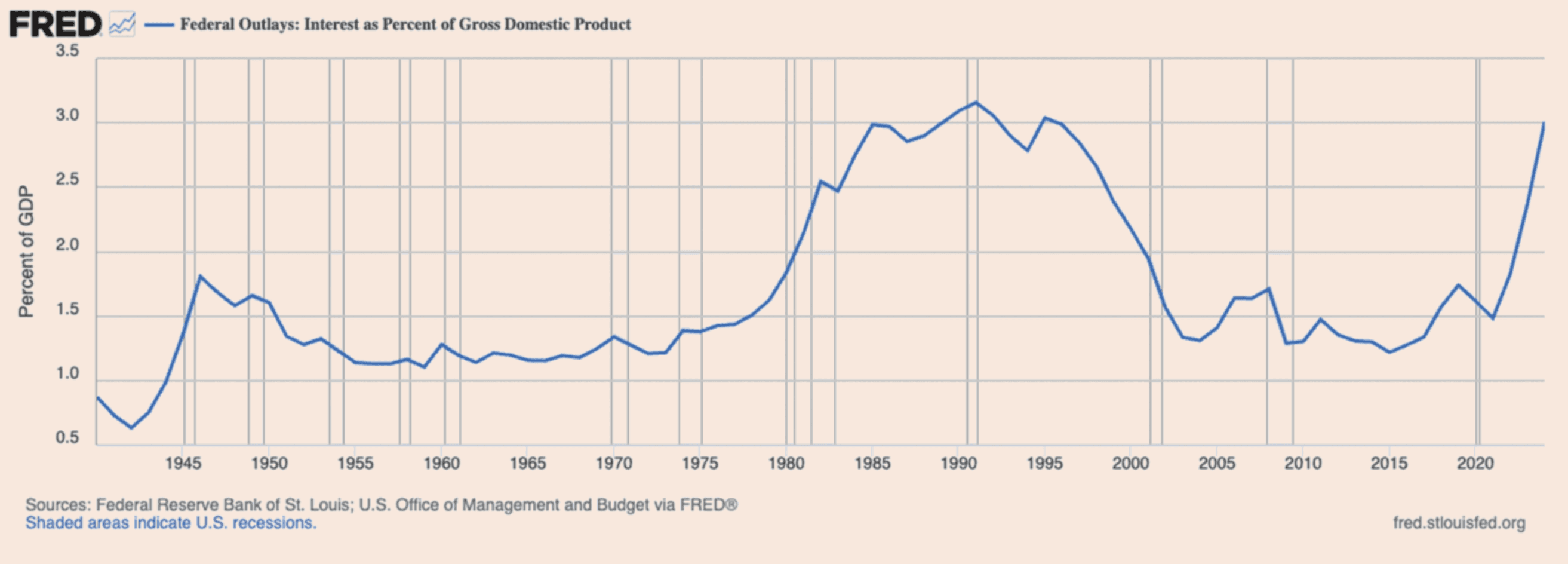

Members noted that it is insightful to look at the FG’s interest payments relative to GDP, in addition to the public debt/GDP ratio. Currently the FG’s interest payments are equivalent to 3.1% of GDP, and that figure continues to grow.

It was noted that this metric is currently approaching its record-high level set in the late 1980s. FG interest payments as a percentage of GDP are currently than during WWI, WWII, and the Great Depression.

Members expressed concern that the growing debt load creates a build up of financial fragility.

The complexity of the financial ecosystem around U.S. Treasuries was also noted. For example, insurance companies and pension funds are large holders of U.S. Treasuries, meaning that a crisis in the FG securities market could have ripple effects through normally sleepy corners of the financial system.

It was also noted that Treasury auctions today are three times oversubscribed indicating that, for the moment, demand for U.S. debt continues strong.

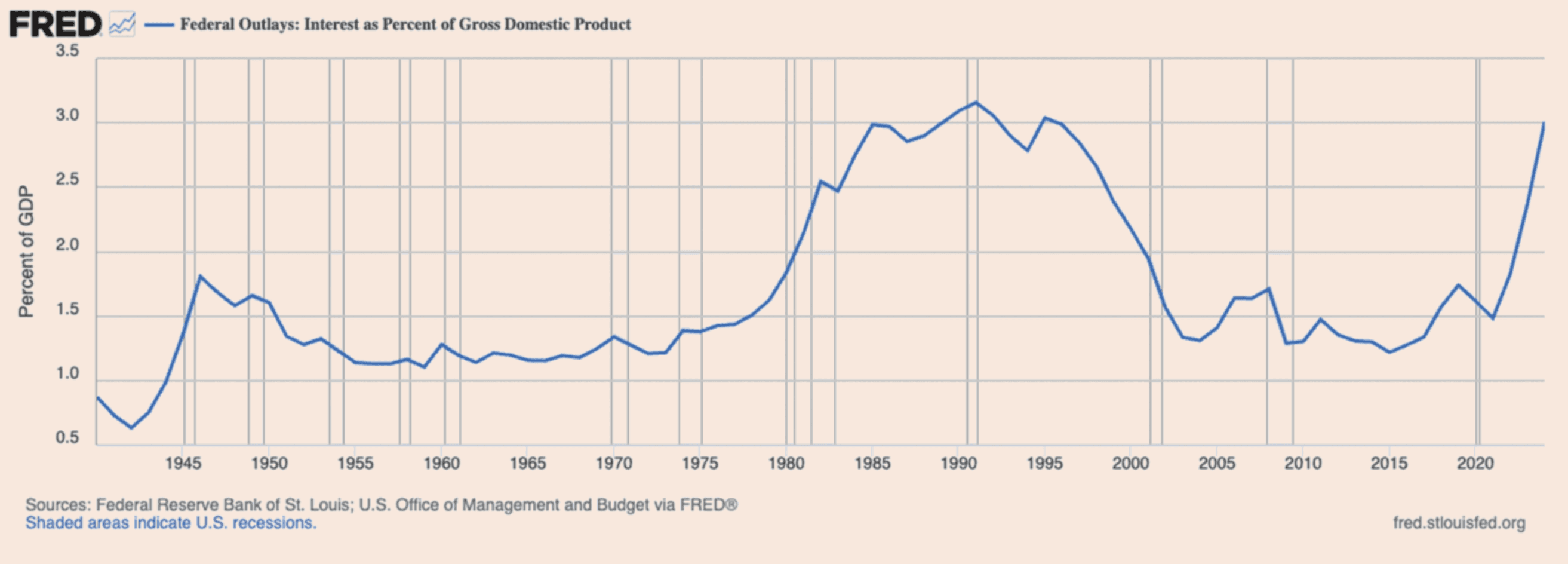

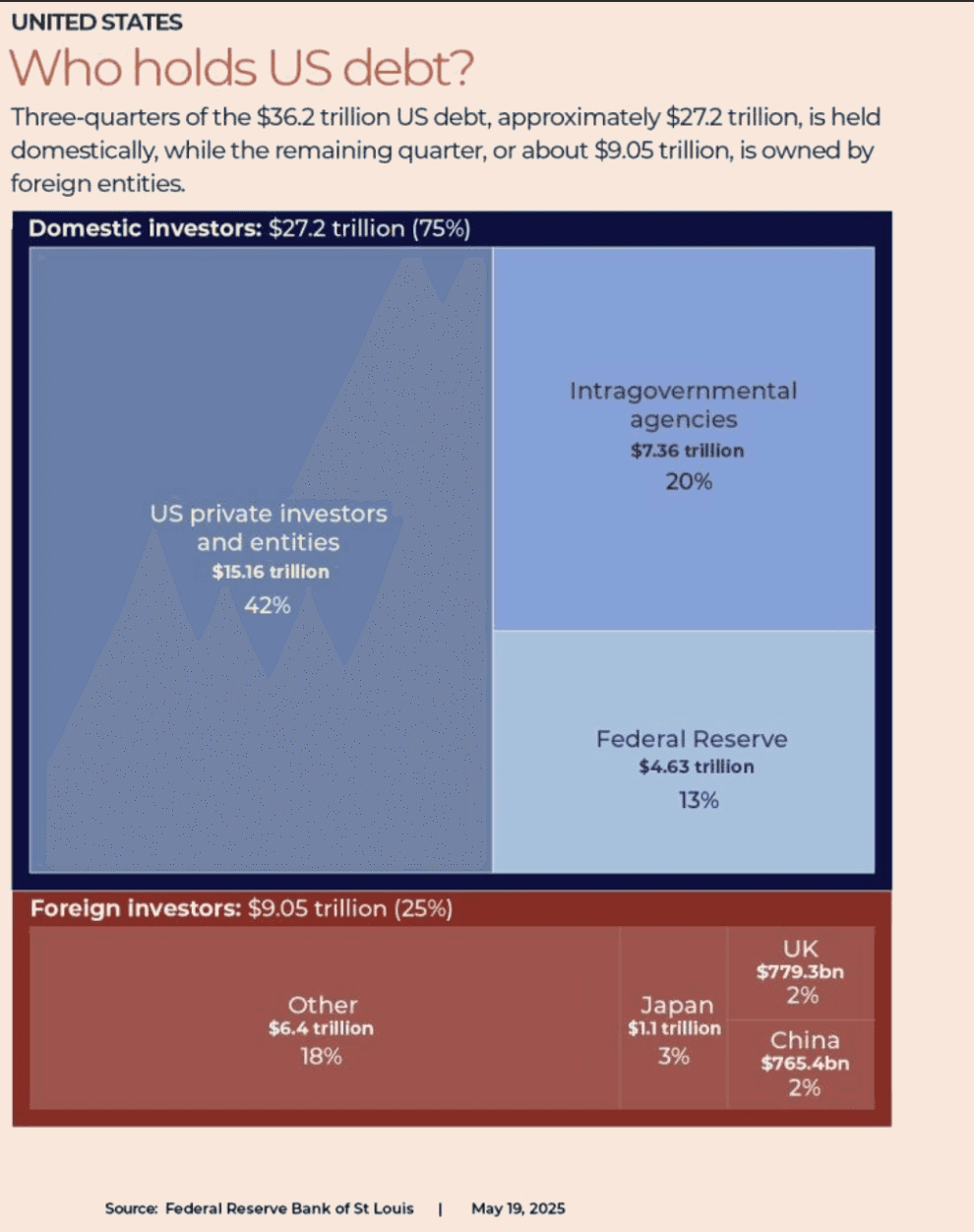

The figure below shows the holders of U.S. FG debt.

- - - - - - -

Crowding Out & Crowding In Effects

The members were asked whether they are concerned about the possibility of ‘crowding out effects’. That is, the Group was asked whether there is a risk that, as the FG’s spending and debt become grow, it appropriates resources which would otherwise have been channeled to private enterprise, thereby displacing private sector activity.

Members agreed that large and growing FG debt could eventually have a crowding out effect.

Reference was also made to the opportunity costs of increasing interest payments. That is, participants expressed concern that as interest payments rise, the government is precluded from reducing taxes or spending money in other ways that may be useful to the country.

In contrast to crowding out effects, it was also noted that government spending can have complementarities with private sector spending rather than a substitute relationship. In other words, government spending can create a “crowding in effect”.

The example of spending on infrastructure was given: there are many instances in which private sector investment would be more effective, and therefore more likely to take place, if the government is spending on infrastructure which supports business. In such scenarios, public spending is complementary to private spending.

However, it was noted that the growing expenditures on Social Security, Medicare, and interest payments are not the type of government spending that produce meaningful crowding in effects.

One member noted that the FG is running deficits while spending disproportionately on programs that don’t have great multiplier effects - rather than building infrastructure or investing in applied sciences research.

Another member expressed the view that, while large public spending can have a stabilizing effect on the economy, it is also an open invitation to economic stagnation.

- - - - - - -

What Are We Spending On & Are We Getting Our Money's Worth?

A contributor put to the Group the following questions: Have we lost the purpose of state spending? Are we happy with the quality of spending? And is our spending producing better infrastructure or facilitating better health and education outcomes?

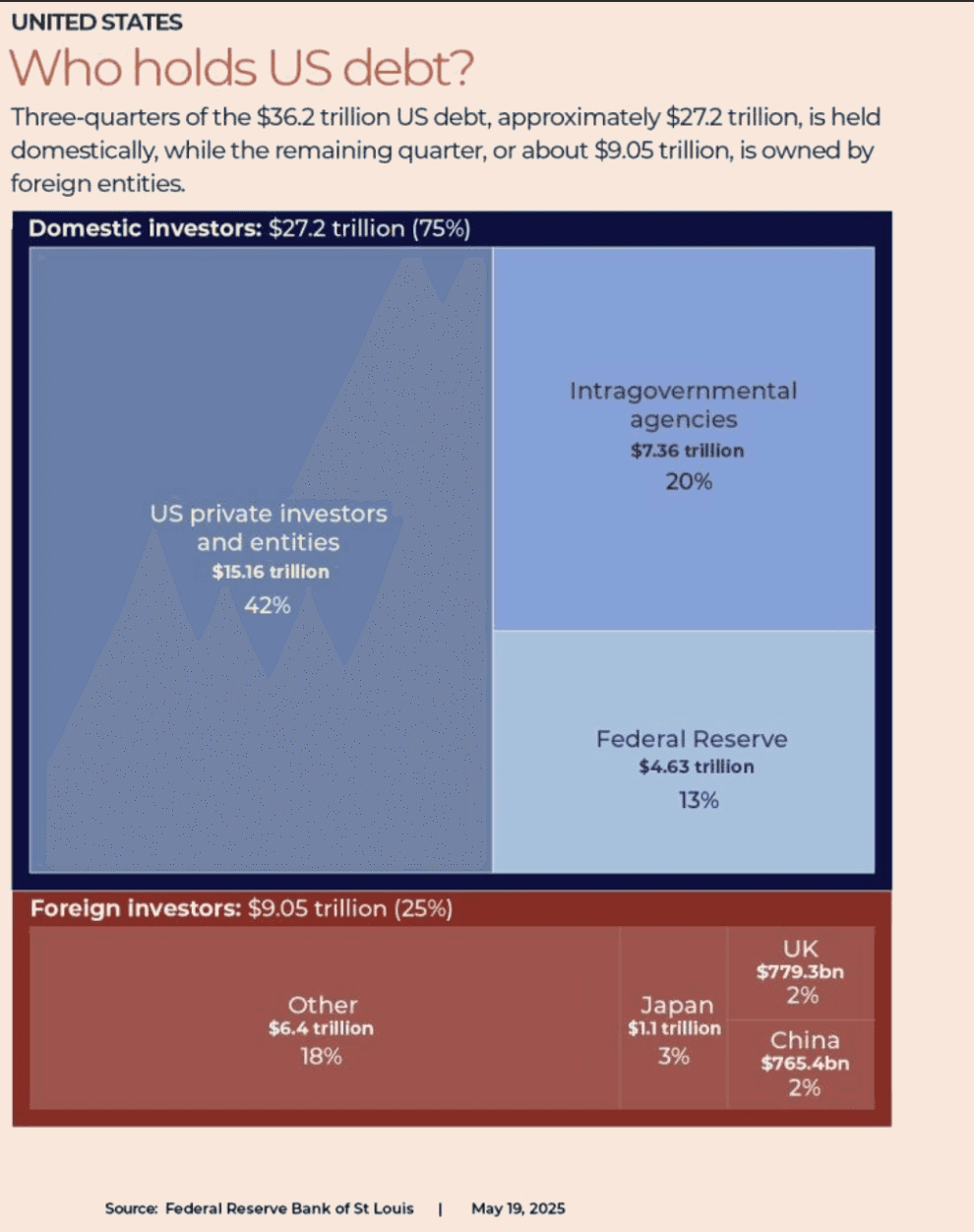

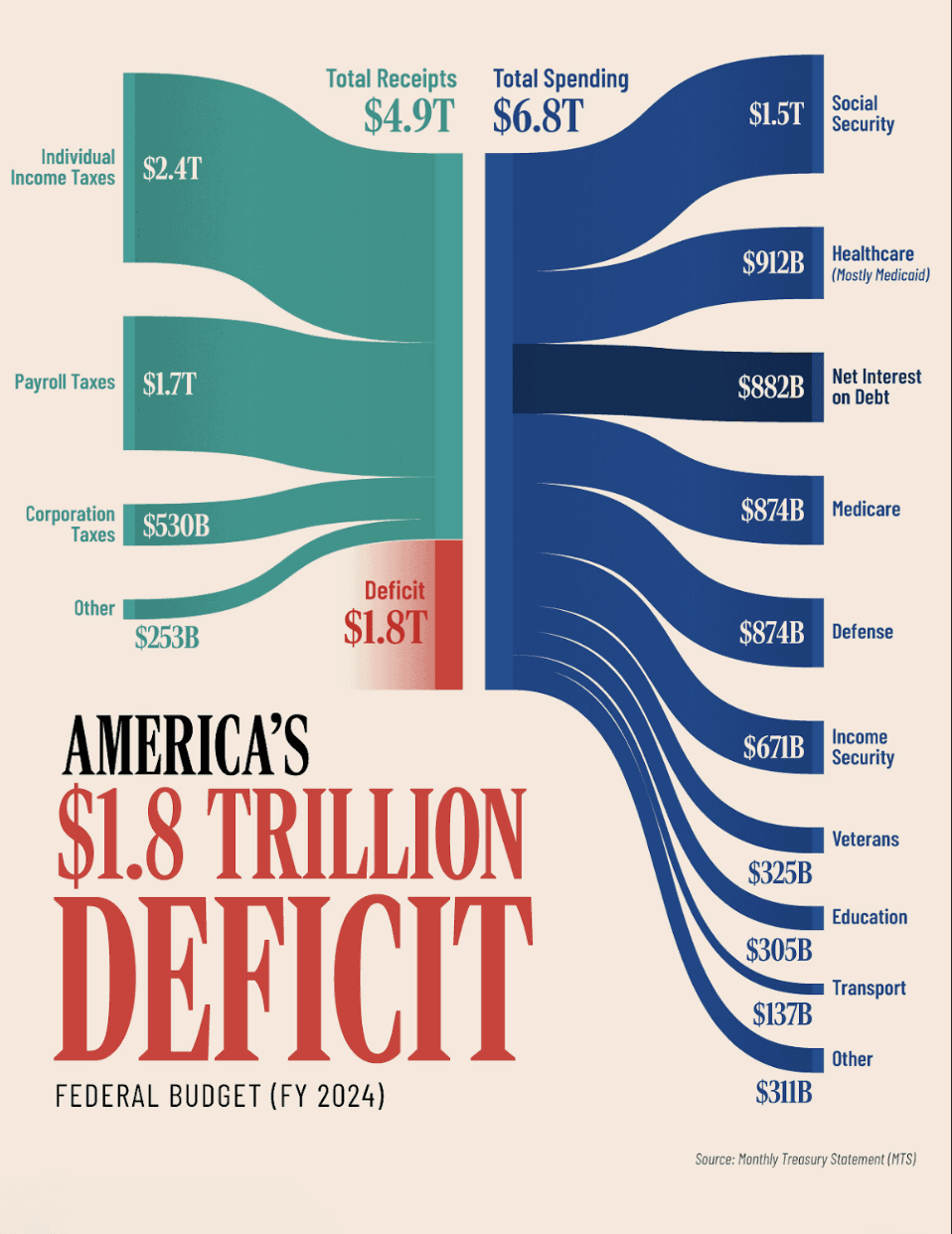

The graph below details the FG 2024 budget deficit, including sources of revenue and areas of expenditure. Notably, it shows that interest payments on debt were the FG's third highest expenditure.

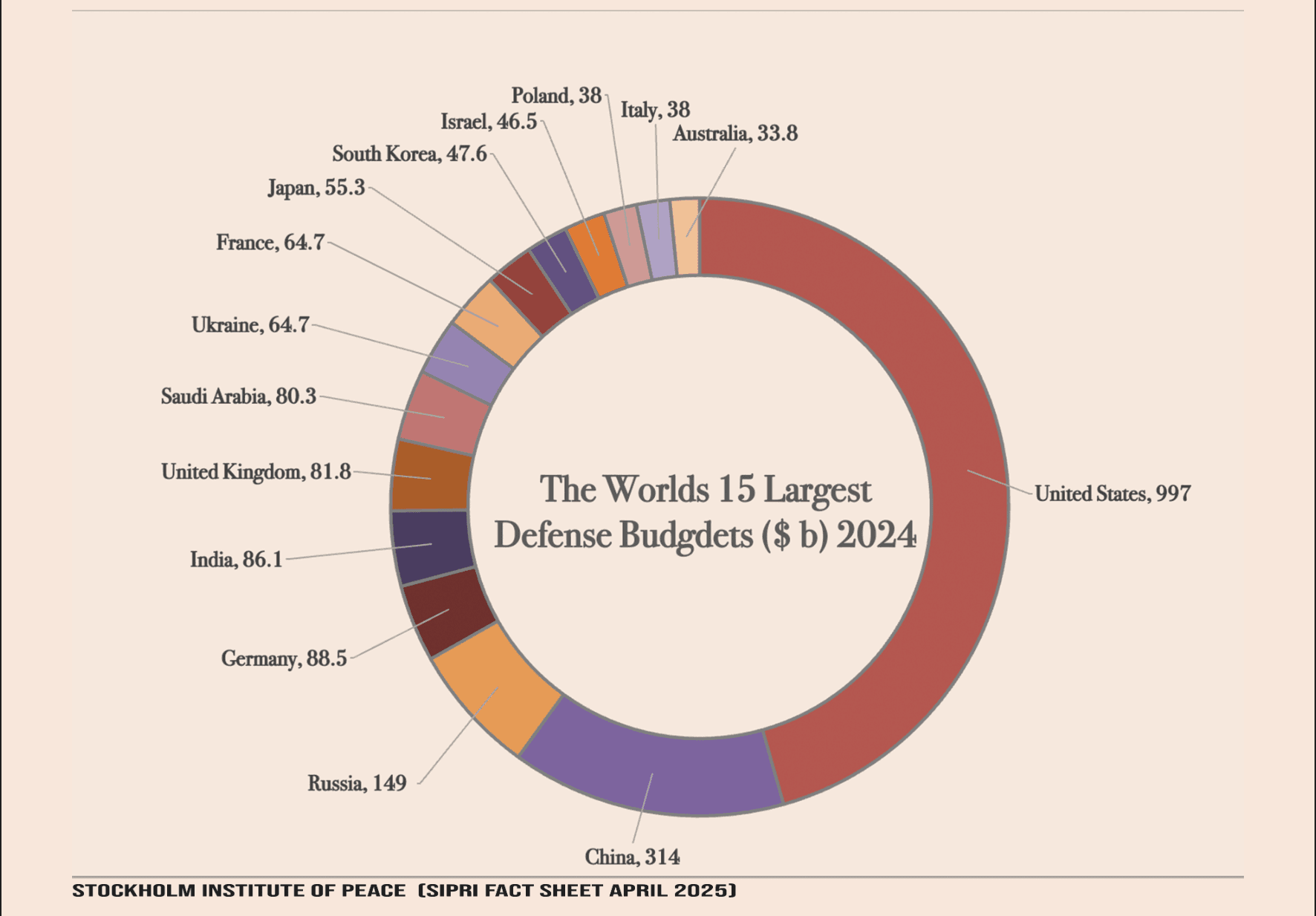

No consensus was reached on the appropriate level of military expenditure.

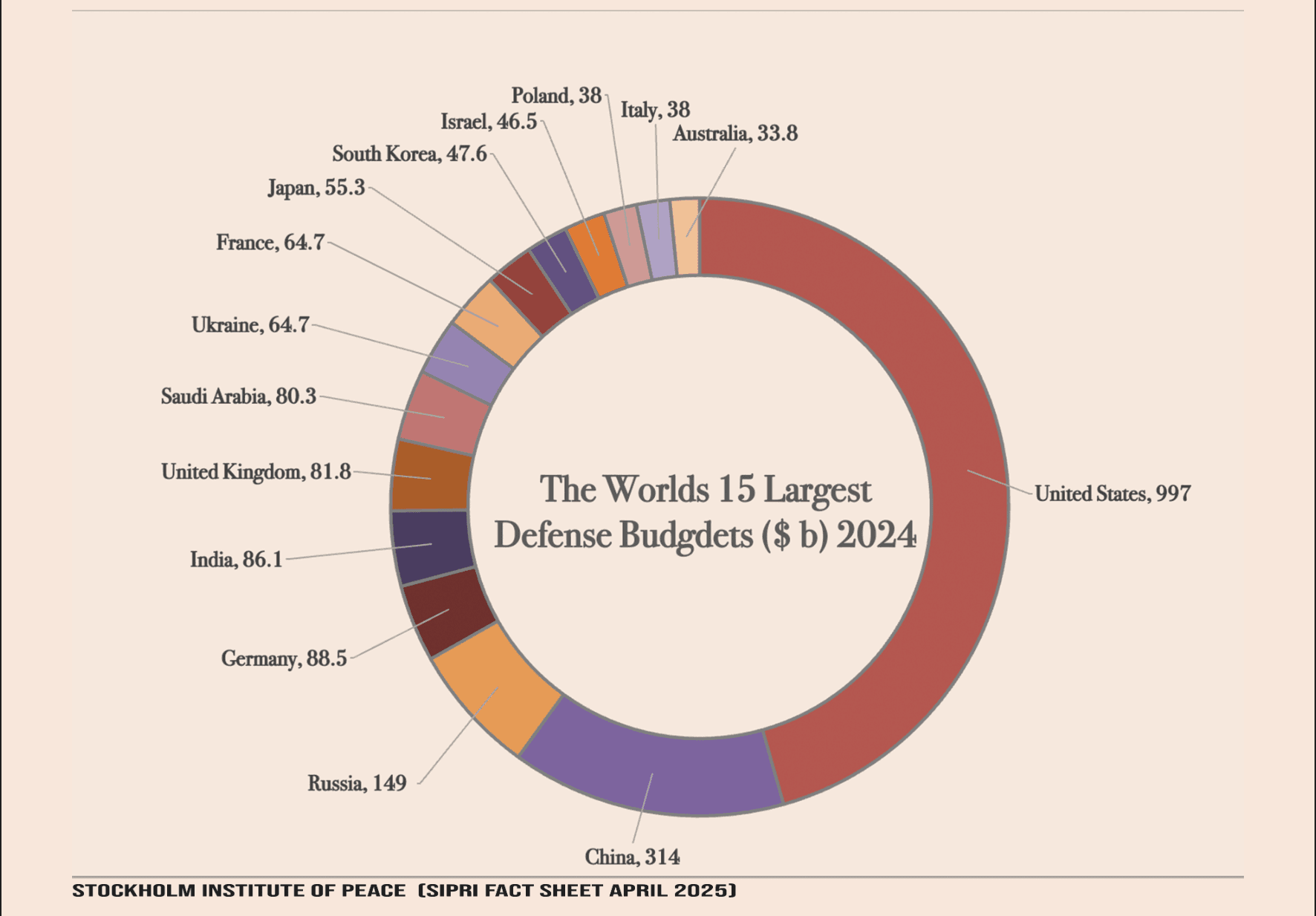

Below is a chart depicting America's military expenditures relative to other large defense spenders. It shows that the U.S. spends more on its military than China, Russia, the U.K., India, and Germany combined spend on theirs.

It was noted that U.S. high school students lag behind international peers in assessments of reading and mathematics.

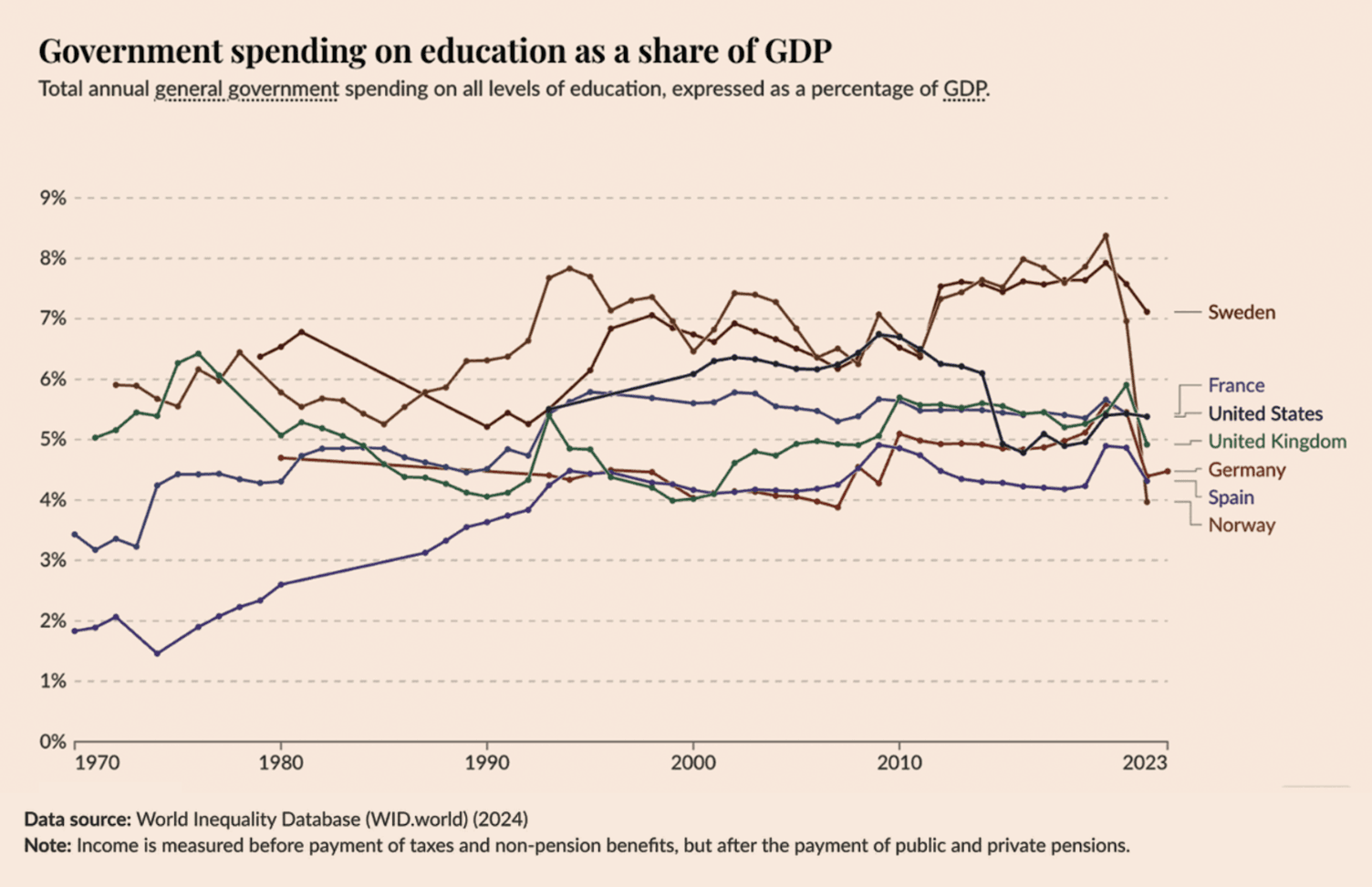

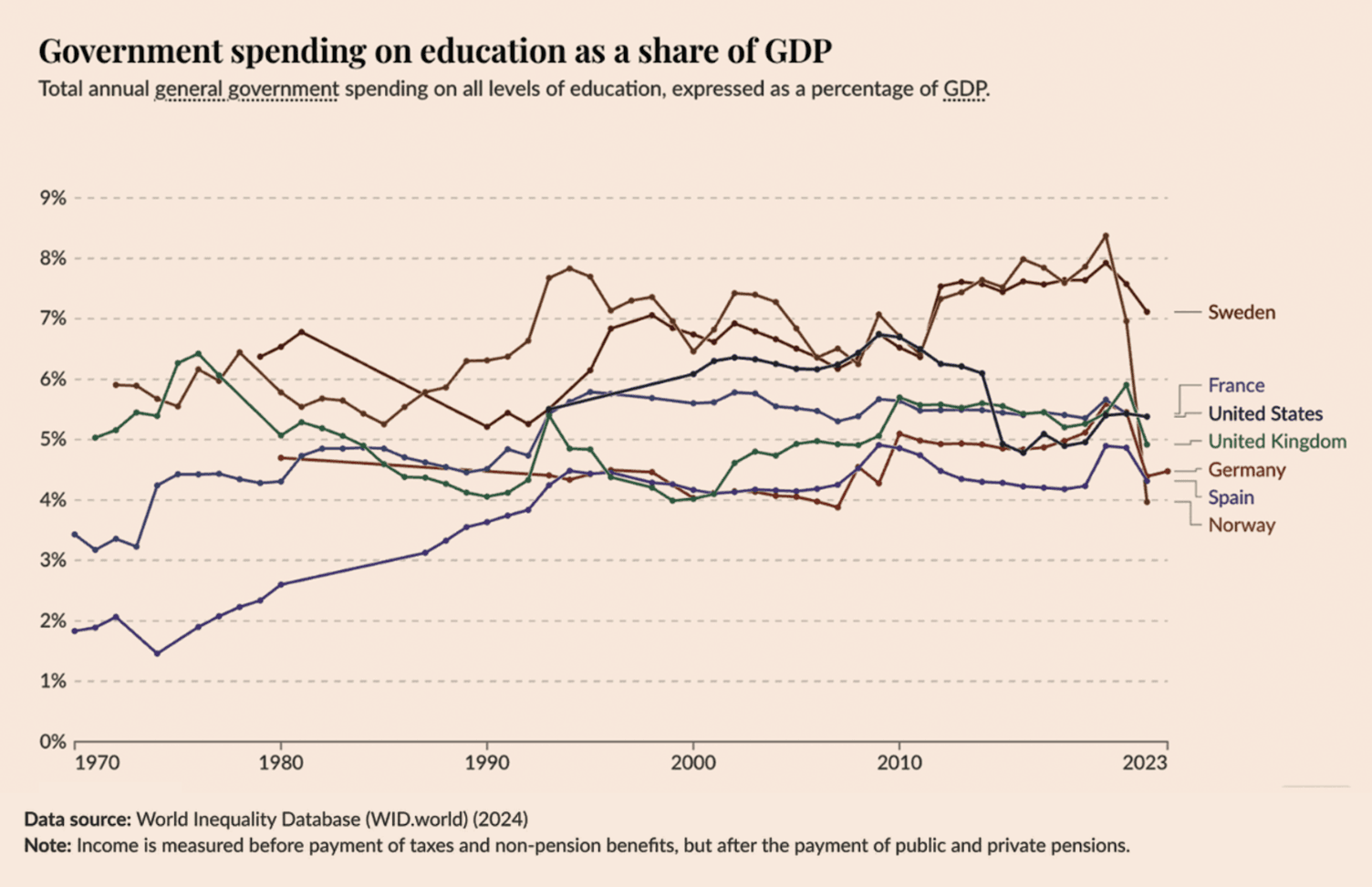

The graph below depicts total annual government spending on education as a share of GDP across seven developed nations from 1970 to 2023. In the United States, most of these funds are spent by local and state governments, and do not directly increase the FG debt.

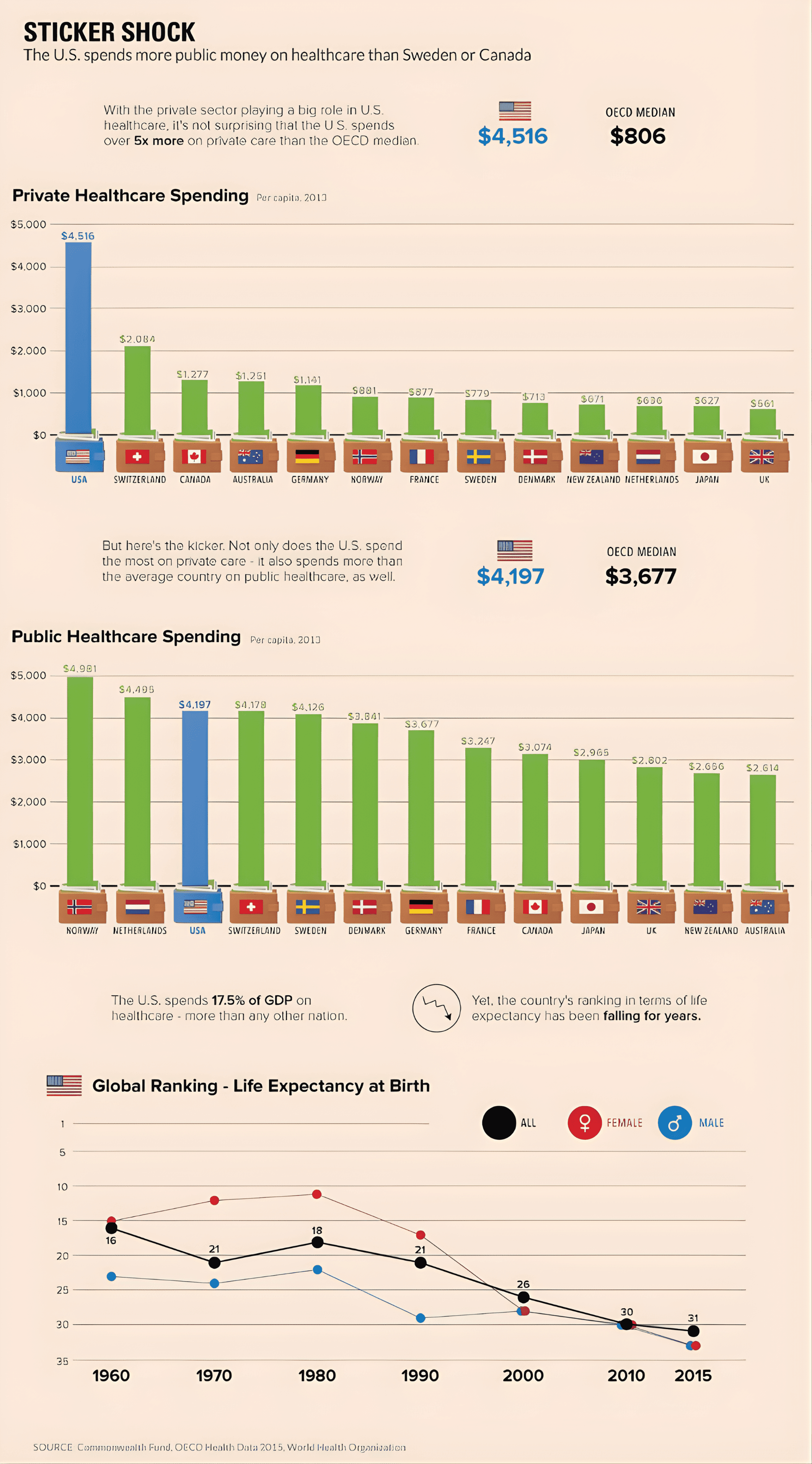

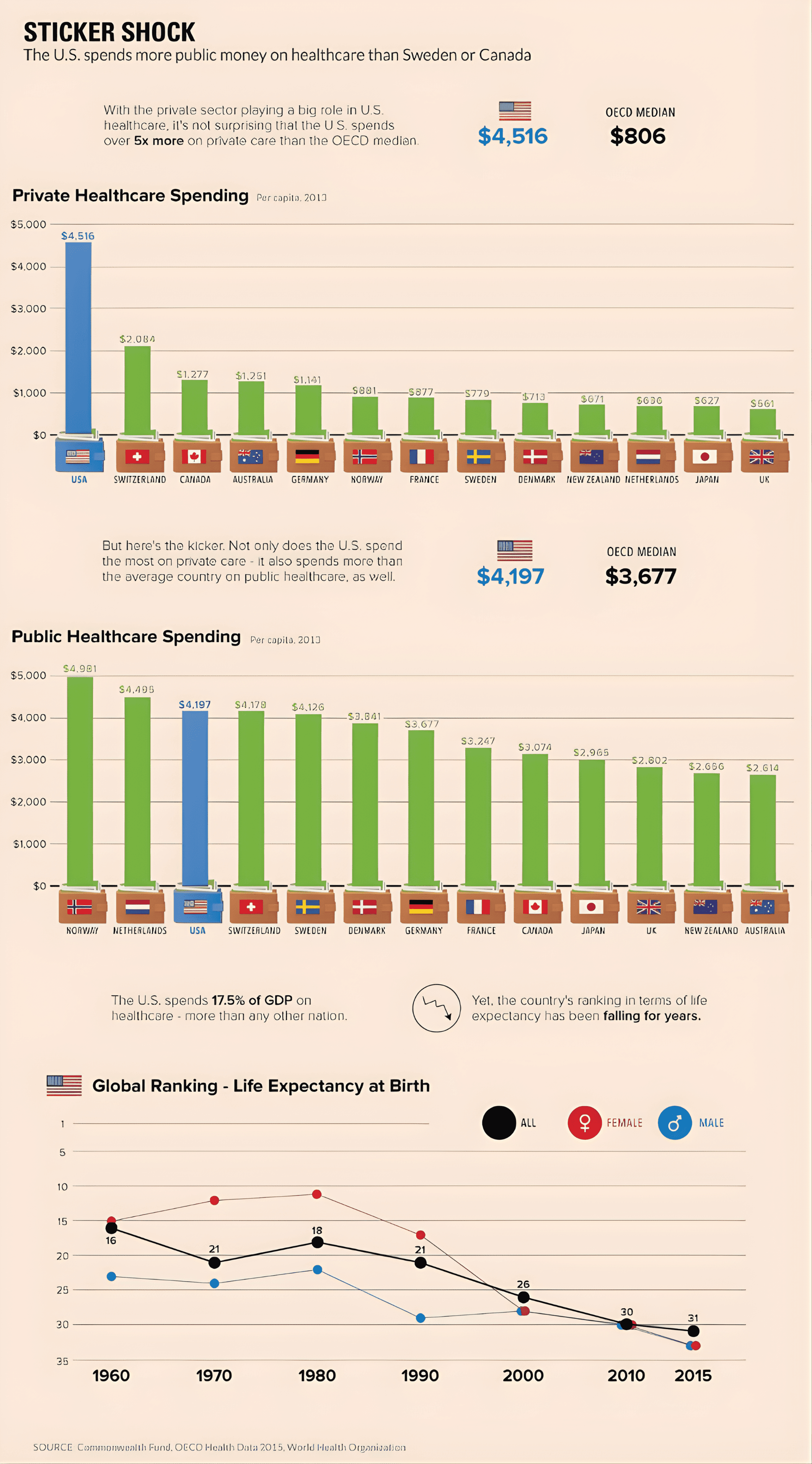

Below is a bar chart showing that the U.S. spends significantly more money - both public and private - than other countries on healthcare. Despite this, America's ranking globally in life expectancy at birth has been declining.

Given the suboptimal educational and health outcomes currently being achieved, the group agreed that it would be appropriate to reassess whether the current composition of FG expenditures are working in the national interest.

- - - - - - -

A Spending or Revenue Problem?

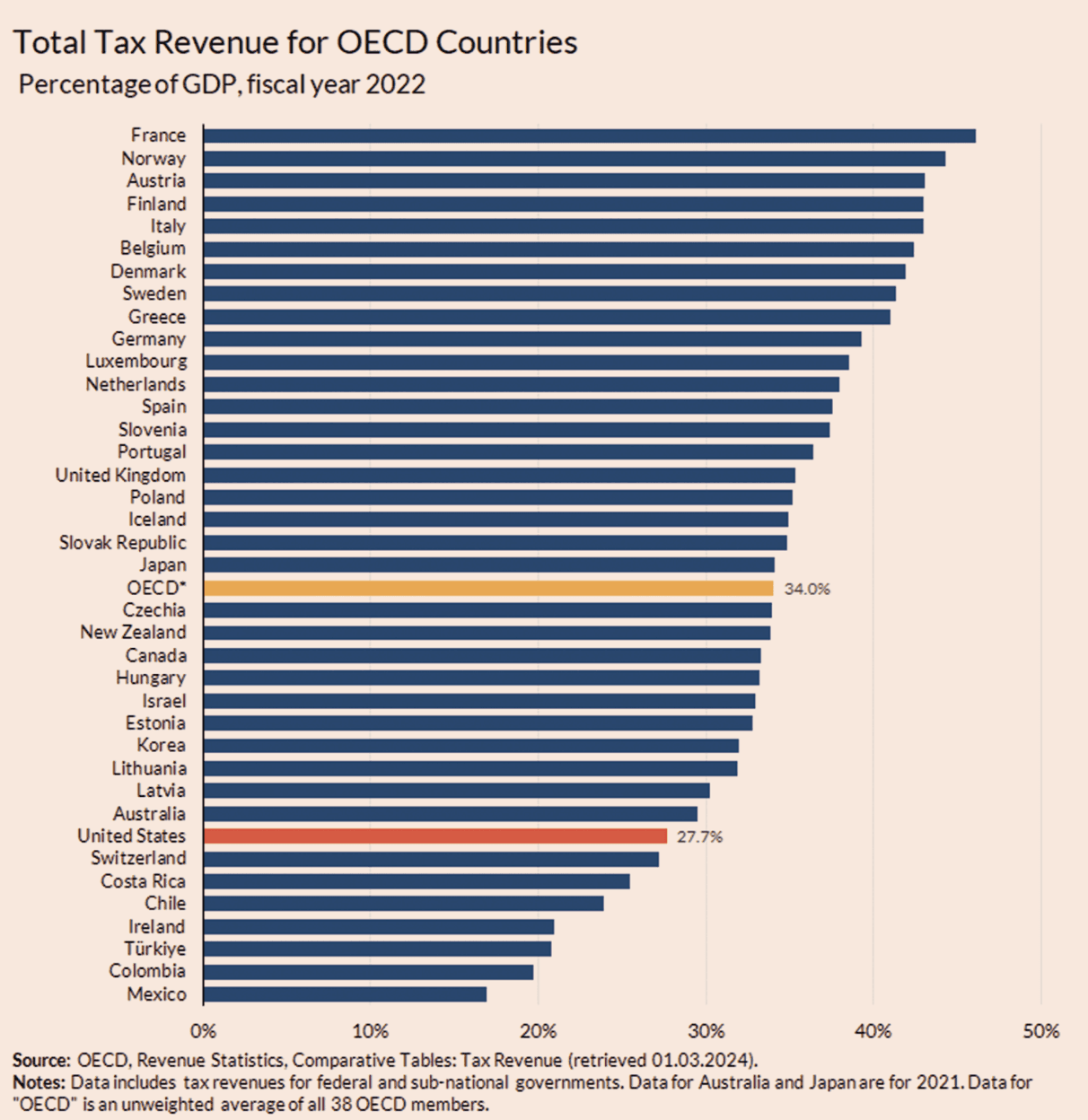

Two members expressed the view that the FG has a revenue problem.

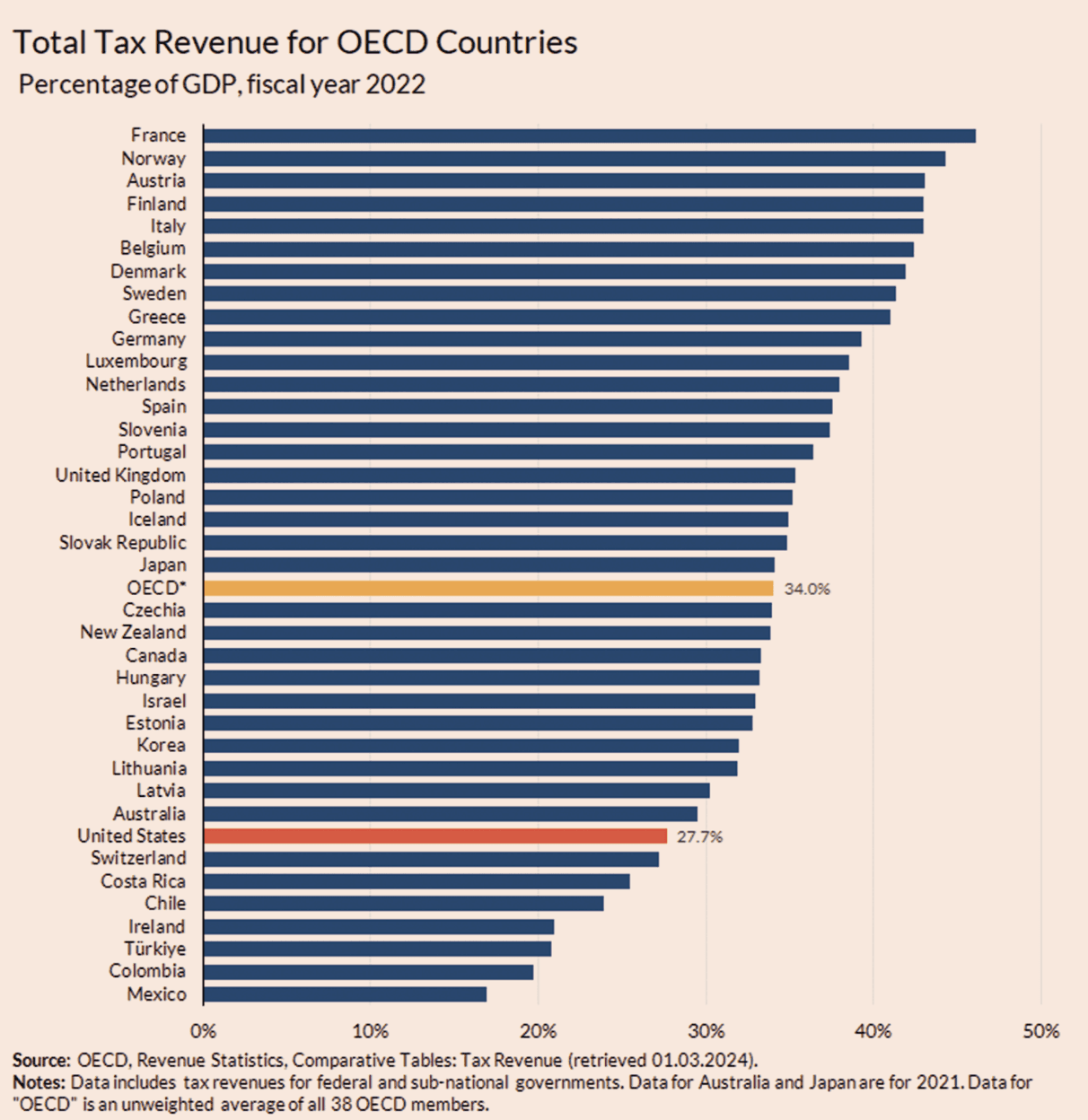

The low U.S. tax burden relative to other developed countries was cited as evidence in favor of this view: even if we combine federal, state, and local taxes, the U.S. tax burden was less than 28% of GDP while the OECD averaged 34% in 2022.

One member concluded that tax rates in the United States will therefore need to rise to address the FG’s fiscal shortfall and that Americans should prepare themselves for this eventuality.

Two members noted that raising taxes on the super-rich alone would not be sufficient to close the fiscal shortfall and suggested that broad tax increases will be required.

One member argued that the FG cannot solve its fiscal shortfall purely on the tax side, and that spending cuts would be necessary.

- - - - - - -

Growing Our Way Out?

It was noted that if the rate of growth of the economy is faster than the rate of growth of the debt stock, many of these problems go away.

This view was seconded by contributors of varying political persuasions.

It was further noted that post-World War II, U.S. FG debt to GDP declined because of strong GDP growth (as well as inflation).

Additionally, contributors noted that if the FG cuts spending simultaneous with private enterprises cutting investment, GDP (the denominator in the debt/GDP ratio) shrinks, making cuts counter to the goal of reducing the debt to GDP ratio. However, the private sector is currently running strong, which prompted the question: is now an appropriate time for spending cuts?

- - - - - - -

Spending Cuts?

A lengthy discussion was had over the topic of spending cuts.

There was a unanimous consensus that, if cuts must take place, they are best done during a period of strong economic expansion and private sector investment, rather than during a downturn.

Two contributors brought up concern about massive inefficiencies in current FG expenditures.

A majority of contributors concurred that the level of spending on health care, particularly when compared to the health outcomes achieved, is enormously wasteful.

A majority of contributors expressed agreement that cuts in certain areas may be appropriate.

Notably, one of the two members who argued that massive inefficiencies in government spending exist also argued that, while there are public spending categories that can be pruned, a reduction in total U.S. public spending is undesirable. Rather, the participant argued that tax revenues will have to increase.

No member took spending cuts off the table. However, there was significant debate over what, how much, and when cuts should take place.

One member noted that, while spending cuts are always politically difficult, in the present populist age, sharp spending cuts are all the more politically challenging.

It was also noted that an emergency scenario could arise which forces austerity - a situation we should very much seek to avoid.

- - - - - - -

The “Exorbitant Burden”

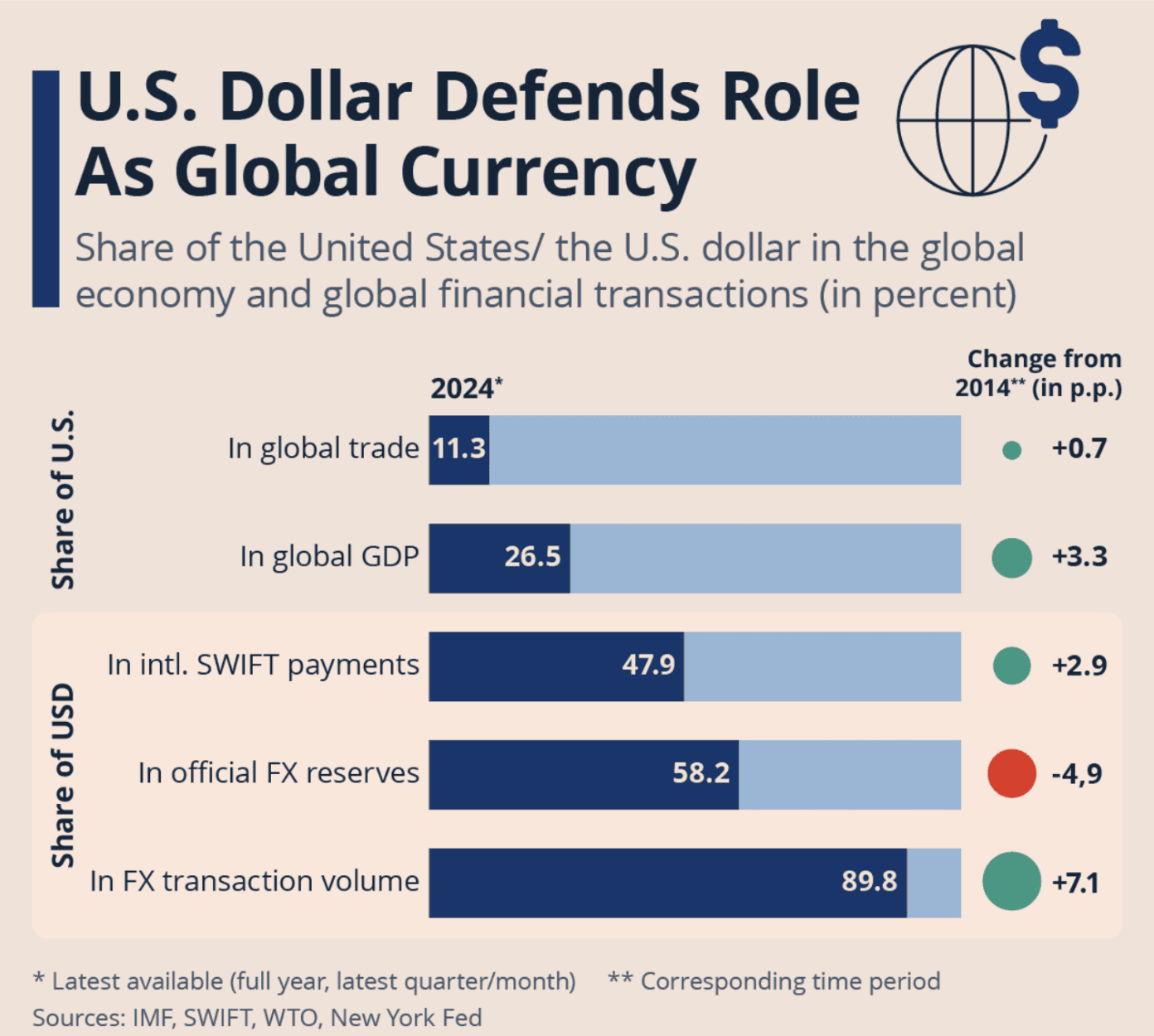

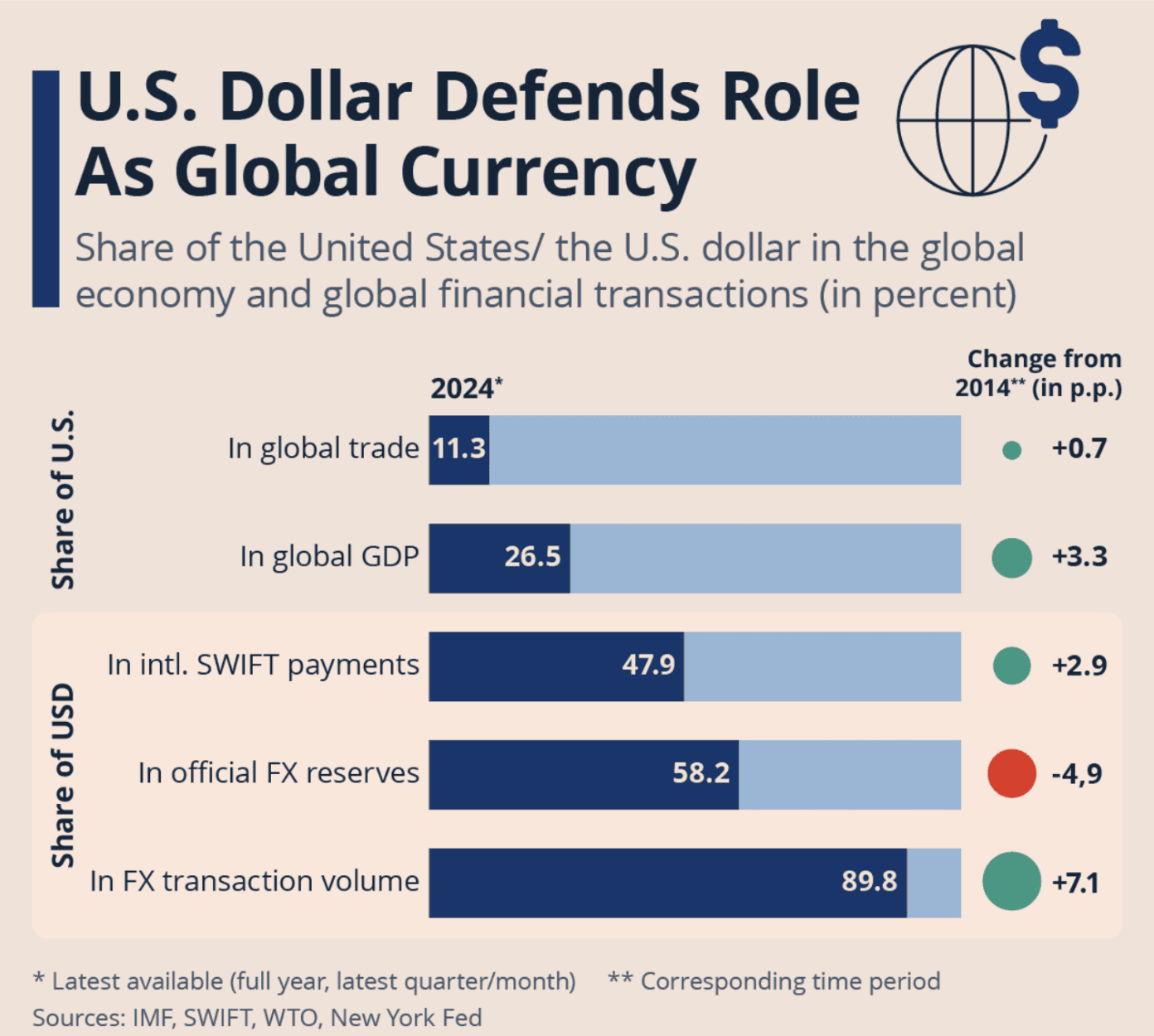

Members expressed concern that the current administration views the ‘exorbitant privilege’ of the U.S. dollar’s role as the global reserve currency as an ‘exorbitant burden’.

A majority of participants noted that long-run indicators suggest the USD could lose its status as the global reserve currency, but when and how remain unclear.

Multiple participants expressed concern that, if we see a decline in the global role of the USD over the next few decades, the FG will find itself facing fiscal constraints it currently does not.

However, it was noted that there is currently no viable alternative to the U.S. dollar as the global reserve currency, which prevents the dollar from losing its dominant position near-term.

- - - - - - -

Could A Policy Mistake Trigger a Crisis?

There was a unanimous consensus that a policy mistake by the FG could trigger a crisis in the Treasury market and expose underlying fragility in the FG’s fiscal position.

It was also noted that these risks are difficult for markets to price in.

Two members brought up the possibility that mishandling the FG debt ceiling could trigger a bond market crisis.

One member noted that, as fragility grows, an exogenous shock may not even be required to trigger a FG fiscal crisis.

- - - - - - -

The Debt Ceiling

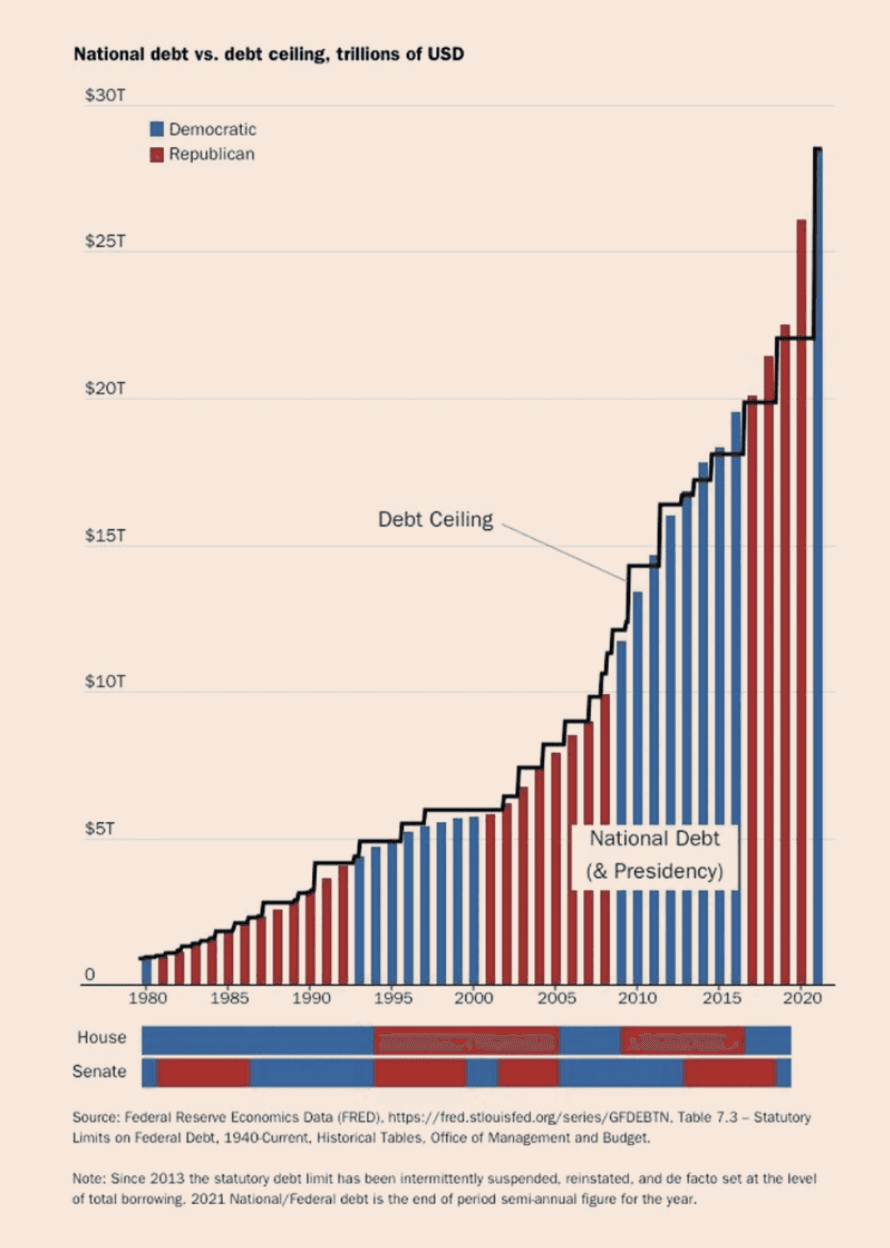

There was a unanimous consensus that the debt ceiling should be abolished.

Multiple contributors described the brinksmanship around the debt ceiling as ‘dangerous political theater’. Two members brought up the possibility that mishandling the debt ceiling could trigger a bond market crisis.

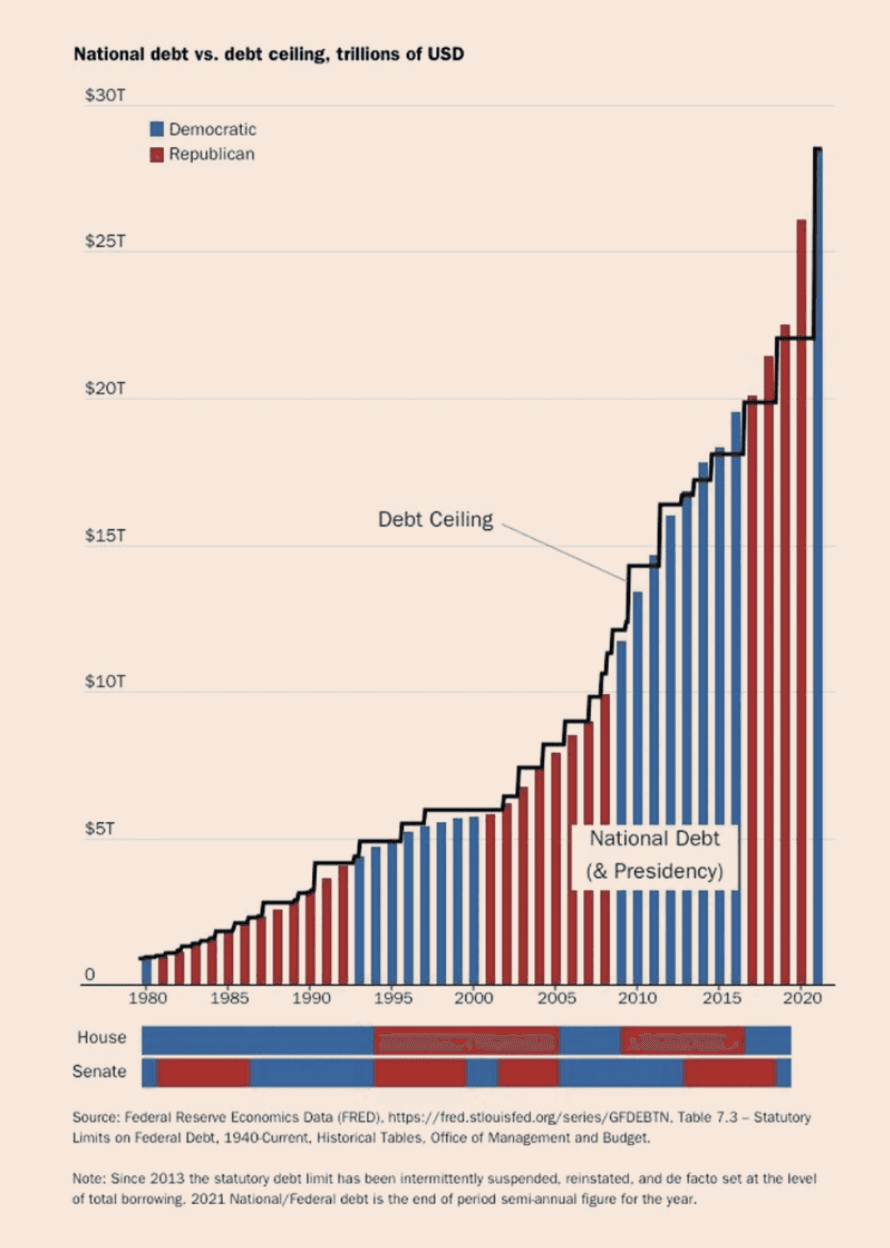

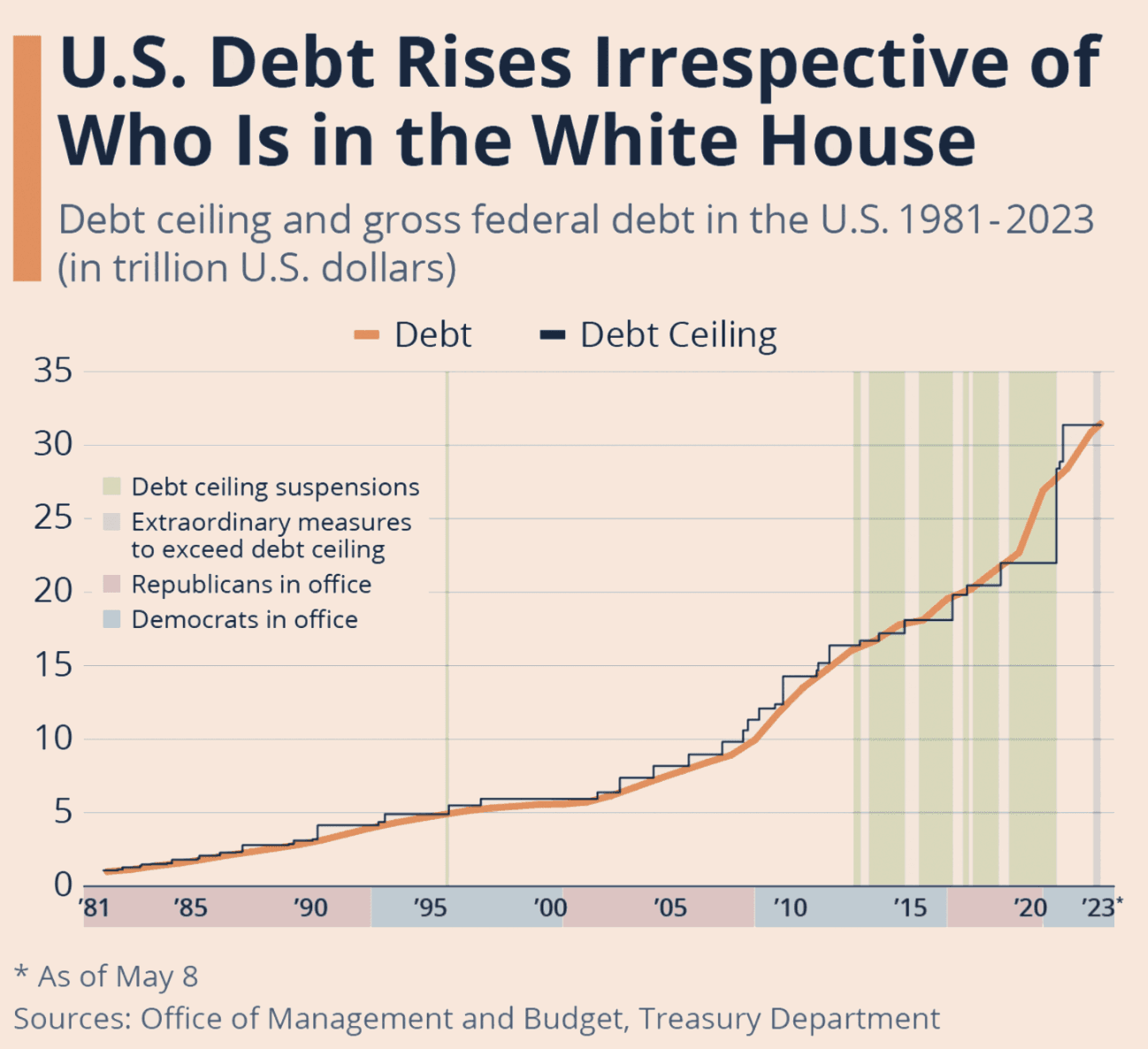

It was also noted that the debt ceiling: 1) has failed to stop the FG debt from rising, 2) was not created with that purpose in mind, and 3) is not a better alternative to the fiscal discipline which, theoretically, should be imposed by the bond market.

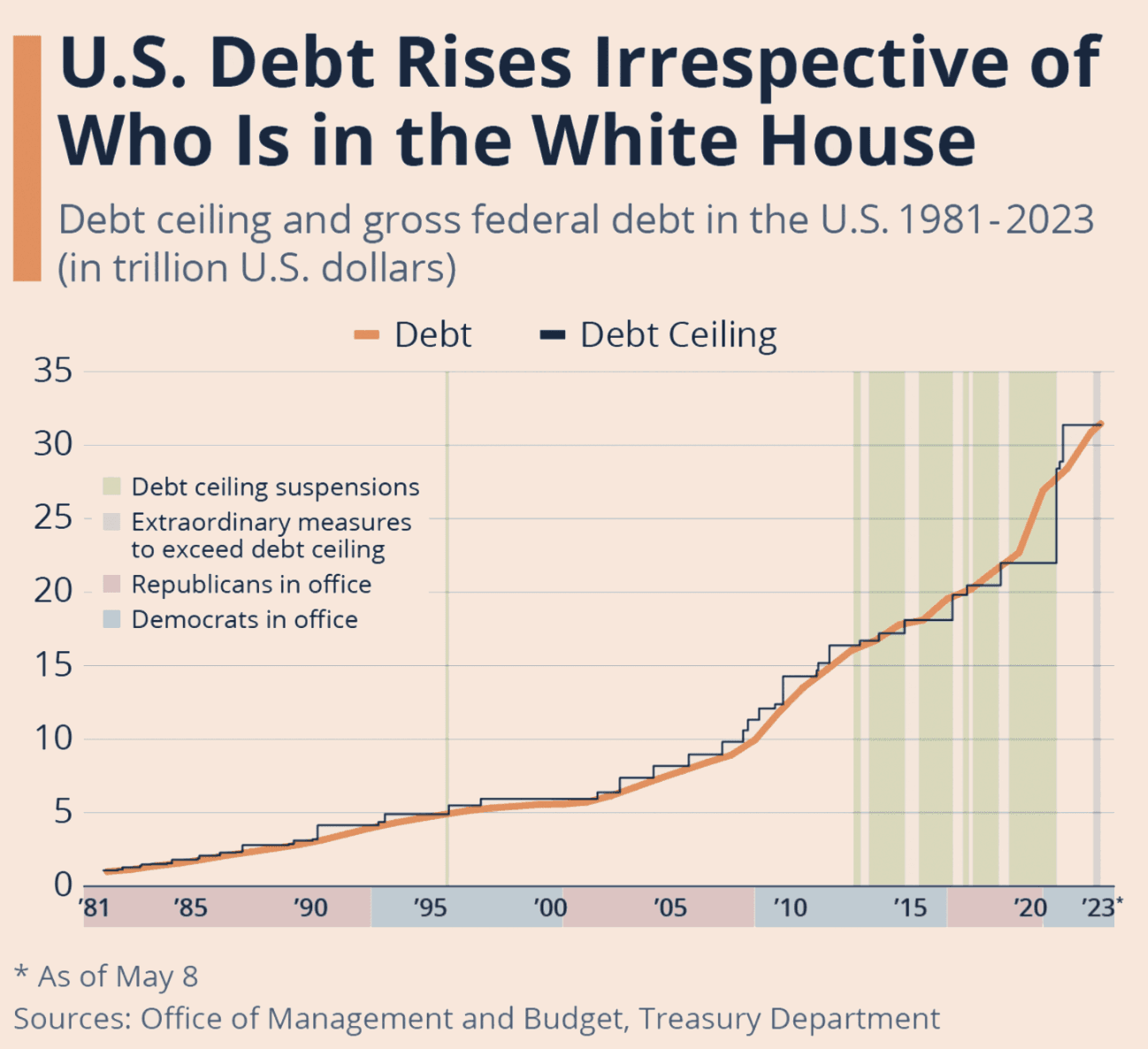

The graph below shows the debt ceiling rising repeatedly since 1980, in tandem with the growing FG debt.

Moreover, the debt ceiling and FG debt have risen regardless of which political party is in the White House.

- - - - - - -

Public Net Worth

One participant argued that the relevant metric when assessing the FG’s fiscal position is not the debt/GDP ratio, but rather the government’s net worth. That is, what matters is the government’s liabilities relative to its assets. This approach assesses the fiscal soundness of the FG the way we might evaluate the financial soundness of a private sector enterprise.

The participant noted that, if we evaluate the FG by taking a comprehensive view of its liabilities relative to its assets, its fiscal position is actually worse than the debt/GDP figure would suggest.

The FG debt to GDP is currently above 100%. And simple metrics suggest the FG had $28 trillion in debt at the end of Q3 2024.

But if we take a balance sheet perspective and include the roughly $15 trillion of projected federal employee and veteran benefits liabilities which are not accounted for in the $28 trillion figure, we find that the FG’s true liabilities stand at north of $40 trillion. In other words, the public debt to GDP figures underestimate the severity of the fiscal situation.

Meanwhile, the FG's assets only add up to $5.6 trillion.

So the true net worth position of the FG is significantly worse than its debt position alone indicates.

The participant noted that many FG assets are mis- or under-valued. Therefore, the true value of the FG’s assets might be higher than $5.6 trillion. For example the U.S. Department of War does not report the value of its real estate.

It was suggested that, if these public assets were managed properly, they could yield non-tax returns to the Treasury and reduce the amount by which taxes will need to be increased or spending decreased.

A counter-note was advanced that taking a balance sheet approach to the FG may risk overlooking characteristics of the FG which are unique to it and not applicable to private sector enterprises, such as the FG’s ability to issue its own currency or increase immigration to expand the tax base. It was also noted that the U.S. has no effective current account constraint, a feature unique to its case.

- - - - - - -

Timing of A Sovereign Debt Crisis?

Participants could not determine with confidence when high FG debt levels might result in a U.S. sovereign debt crisis.

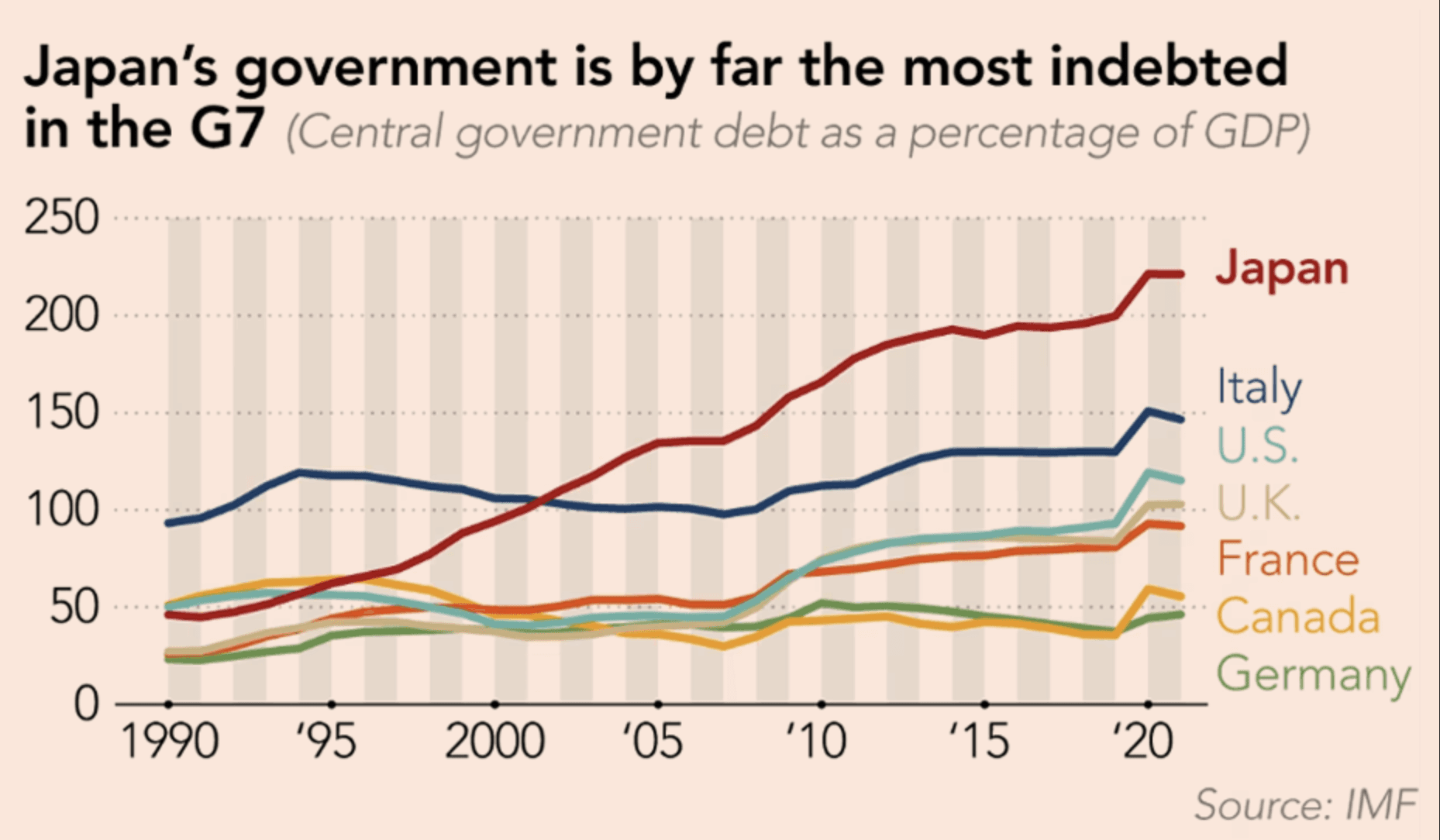

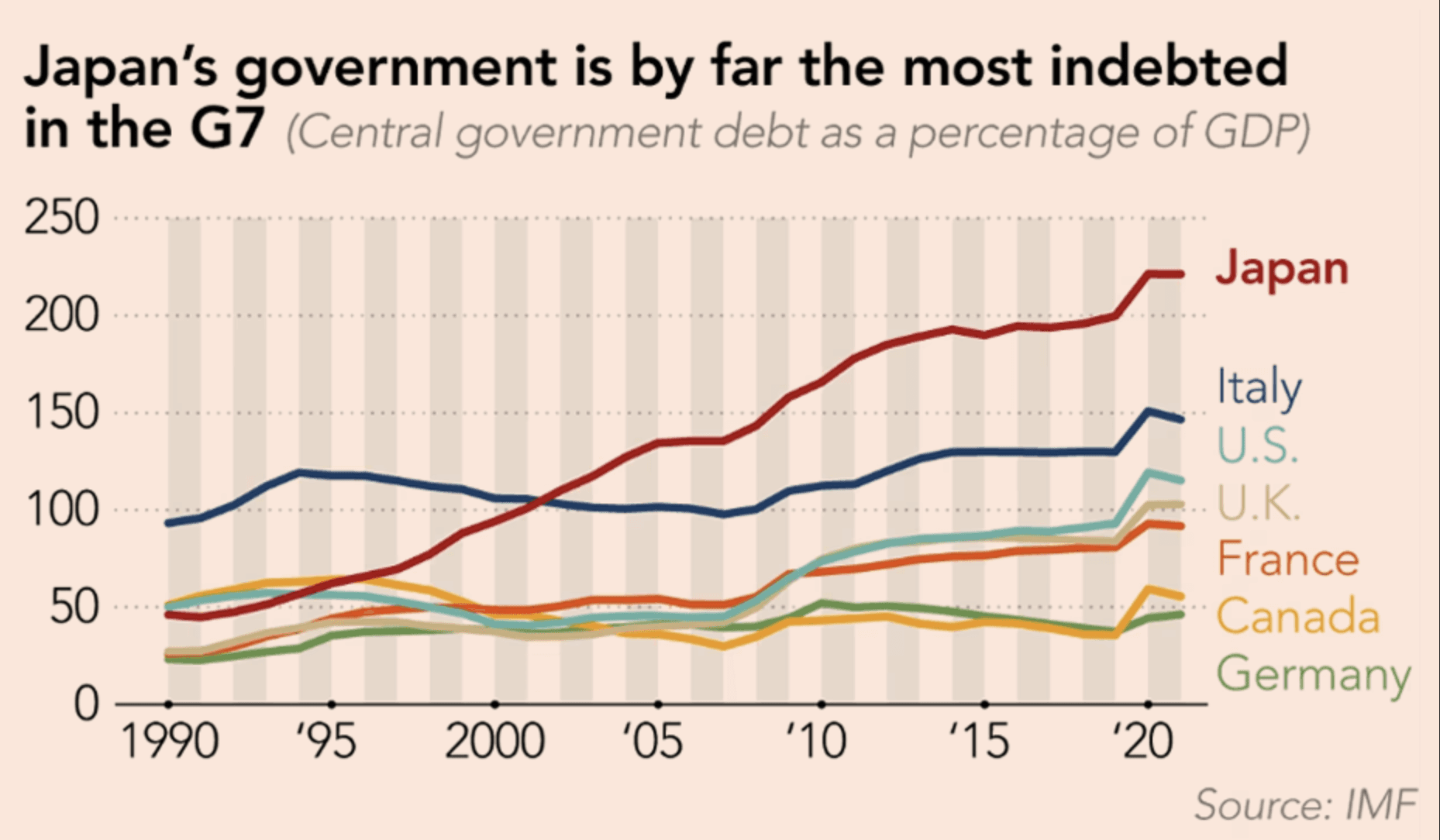

The case study of Japan was noted in reference to the difficulty of determining how and when debt crises might play out: its central government carries the world’s highest debt/GDP ratio, but this has not yet resulted in a crisis.

One contributor expressed an expectation of debt monetization, a loss of federal reserve independence, and a higher rate of inflation, rather than an outright default.

- - - - - - -

Raising The Retirement Age

Given the increase in ‘health expectancies’ America has experienced over the last few decades, all members were open to the possibility of raising the ages at which workers qualify for federal retirement benefits as part of the series of initiatives to address the FG fiscal shortfall.

One member recommended a differentiated system of retirement ages under which workers in physically demanding professions (e.g. coal mining) would have an earlier retirement age than those in less physically strenuous roles.

Another member suggested that the retirement age be uniform across industries with the expectation that people can change jobs as they age out of more physically strenuous jobs.

Participants agreed that these changes could be grandfathered in incrementally.

- - - - - - -

The ‘Government As Household’ Analogy

Participants were asked whether they believe the ‘government as household’ analogy is useful.

Two members view the analogy as having issues but being potentially useful in the public discourse. They argue that it can help simplify what could otherwise be a complex conversation about things like credit spreads and yield curves. It can also help with understanding the need to focus on the quality of expenditures.

One member argued that it can be helpful if used well, but is unlikely to be used appropriately, and so it’s better for policy-makers to avoid it.

Three members said the analogy is not helpful and should be discarded by policy-makers. One of these three members argued that, rather than using analogies, the emphasis should be on education, with politicians educating the public on the policy tradeoffs they face and the public, in turn, educating the politicians on the decisions they’d like to see taken.

Thus, a four to two majority of members recommend that policy-makers avoid using the 'government as household' analogy.

- - - - - - -

Demography

All contributors expressed concern about how demographic changes will affect the fiscal position of the country - though it is difficult to determine exactly how.

The example of Japan was given as a case study in the complexity of determining how demographic decline may affect the FG fiscal position.

On the one hand, a declining population without immigration shrinks the labor market causing, all else equal, wages/costs to go up and thereby resulting in inflation.

On the other hand, older people spend less and save more, which tends, all else equal, to subdue inflation.

So declining fertility produces countervailing tendencies, making it difficult to predict exactly what its impact on the FG fiscal position and other economic variables may be.

——————

Written By: Aiden Singh

Published: January 6, 2026

Content

Fiscal Policy Report

- Dec. 2025

Contributors

Mark Blyth

Professor of International Economics & Professor of International and Public Affairs, Brown University

Willem Buiter

Former Member of the Monetary Policy Committee of the Bank of England, Global Chief Economist at Citigroup, & Professor at the LSE

Igor Luksic

Former Prime Minister, Finance Minister, & Foreign Minister of Montenegro

Raymond Ojserkis

Lecturer of History, Rutgers University

Francesco Brindisi

New York City Executive Deputy Comptroller for Accountancy, Budget, & Public Finance

Robert Guttmann

Professor of Economics, Hofstra University

Policy-makers seeking further fiscal policy insights & c-suiters who would like to join our future summits can get in touch here.

Introduction

The State of the Union Working Group on Fiscal Policy convened on December 2, 2025 to review the fiscal position of the United States Federal Government (FG, hereafter).

Six members of the Working Group met under Chatham House rules.

The Group’s membership is comprised of policy-makers and economists across the political spectrum with Keynesian & Austrian, left & right perspectives represented.

This report summarises the areas of consensus, disagreement, and concern amongst members of the Working Group.

- - - - - - -

Executive Summary

There was a unanimous consensus amongst the six contributors - across left and right political persuasions - that the fiscal position of the U.S. federal government is cause for concern and is on an unsustainable trajectory.

There was a unanimous consensus that a policy error could trigger a crisis in the U.S. Treasury market which exposes the fragility of the federal fiscal position.

There was a unanimous consensus that the federal debt ceiling should be abolished.

Of the five members who gave a view on the issue, all expressed concern that growing federal interest payments and debt issuance could eventually crowd out private sector investment.

There was a four to two majority in opposition to the ‘government as household’ analogy as being used in the public discourse on fiscal policy, with the dissenting two members viewing it as imperfect but at times helpful.

There was a unanimous consensus that raising the ages of qualification for federal retirement benefits could play a part in alleviating the fiscal burden on the federal government.

There was a unanimous consensus that declining fertility rates and the demographic challenges they are expected to engender will have significant implications for the federal fiscal position - though it remains unclear how all the second and third order effects of these changes will impact the fiscal trajectory.

Of the five members who expressed a view on the issue, all believe that future environmental challenges will place additional strain on the FG’s fiscal position.

- - - - - - -

Severity of the Fiscal Situation

The Group was asked how concerned it is about the fiscal position of the federal government. All six members expressed concern about the current trajectory of the FG’s debt.

Members noted that it is insightful to look at the FG’s interest payments relative to GDP, in addition to the public debt/GDP ratio. Currently the FG’s interest payments are equivalent to 3.1% of GDP, and that figure continues to grow.

It was noted that this metric is currently approaching its record-high level set in the late 1980s. FG interest payments as a percentage of GDP are currently than during WWI, WWII, and the Great Depression.

Members expressed concern that the growing debt load creates a build up of financial fragility.

The complexity of the financial ecosystem around U.S. Treasuries was also noted. For example, insurance companies and pension funds are large holders of U.S. Treasuries, meaning that a crisis in the FG securities market could have ripple effects through normally sleepy corners of the financial system.

It was also noted that Treasury auctions today are three times oversubscribed indicating that, for the moment, demand for U.S. debt continues strong.

The figure below shows the holders of U.S. FG debt.

- - - - - - -

Crowding Out & Crowding In Effects

The members were asked whether they are concerned about the possibility of ‘crowding out effects’. That is, the Group was asked whether there is a risk that, as the FG’s spending and debt become grow, it appropriates resources which would otherwise have been channeled to private enterprise, thereby displacing private sector activity.

Members agreed that large and growing FG debt could eventually have a crowding out effect.

Reference was also made to the opportunity costs of increasing interest payments. That is, participants expressed concern that as interest payments rise, the government is precluded from reducing taxes or spending money in other ways that may be useful to the country.

In contrast to crowding out effects, it was also noted that government spending can have complementarities with private sector spending rather than a substitute relationship. In other words, government spending can create a “crowding in effect”.

The example of spending on infrastructure was given: there are many instances in which private sector investment would be more effective, and therefore more likely to take place, if the government is spending on infrastructure which supports business. In such scenarios, public spending is complementary to private spending.

However, it was noted that the growing expenditures on Social Security, Medicare, and interest payments are not the type of government spending that produce meaningful crowding in effects.

One member noted that the FG is running deficits while spending disproportionately on programs that don’t have great multiplier effects - rather than building infrastructure or investing in applied sciences research.

Another member expressed the view that, while large public spending can have a stabilizing effect on the economy, it is also an open invitation to economic stagnation.

- - - - - - -

What Are We Spending On & Are We Getting Our Money's Worth?

A contributor put to the Group the following questions: Have we lost the purpose of state spending? Are we happy with the quality of spending? And is our spending producing better infrastructure or facilitating better health and education outcomes?

The graph below details the FG 2024 budget deficit, including sources of revenue and areas of expenditure. Notably, it shows that interest payments on debt were the FG's third highest expenditure.

No consensus was reached on the appropriate level of military expenditure.

Below is a chart depicting America's military expenditures relative to other large defense spenders. It shows that the U.S. spends more on its military than China, Russia, the U.K., India, and Germany combined spend on theirs.

It was noted that U.S. high school students lag behind international peers in assessments of reading and mathematics.

The graph below depicts total annual government spending on education as a share of GDP across seven developed nations from 1970 to 2023. In the United States, most of these funds are spent by local and state governments, and do not directly increase the FG debt.

Below is a bar chart showing that the U.S. spends significantly more money - both public and private - than other countries on healthcare. Despite this, America's ranking globally in life expectancy at birth has been declining.

Given the suboptimal educational and health outcomes currently being achieved, the group agreed that it would be appropriate to reassess whether the current composition of FG expenditures are working in the national interest.

- - - - - - -

A Spending or Revenue Problem?

Two members expressed the view that the FG has a revenue problem.

The low U.S. tax burden relative to other developed countries was cited as evidence in favor of this view: even if we combine federal, state, and local taxes, the U.S. tax burden was less than 28% of GDP while the OECD averaged 34% in 2022.

One member concluded that tax rates in the United States will therefore need to rise to address the FG’s fiscal shortfall and that Americans should prepare themselves for this eventuality.

Two members noted that raising taxes on the super-rich alone would not be sufficient to close the fiscal shortfall and suggested that broad tax increases will be required.

One member argued that the FG cannot solve its fiscal shortfall purely on the tax side, and that spending cuts would be necessary.

- - - - - - -

Growing Our Way Out?

It was noted that if the rate of growth of the economy is faster than the rate of growth of the debt stock, many of these problems go away.

This view was seconded by contributors of varying political persuasions.

It was further noted that post-World War II, U.S. FG debt to GDP declined because of strong GDP growth (as well as inflation).

Additionally, contributors noted that if the FG cuts spending simultaneous with private enterprises cutting investment, GDP (the denominator in the debt/GDP ratio) shrinks, making cuts counter to the goal of reducing the debt to GDP ratio. However, the private sector is currently running strong, which prompted the question: is now an appropriate time for spending cuts?

- - - - - - -

Spending Cuts?

A lengthy discussion was had over the topic of spending cuts.

There was a unanimous consensus that, if cuts must take place, they are best done during a period of strong economic expansion and private sector investment, rather than during a downturn.

Two contributors brought up concern about massive inefficiencies in current FG expenditures.

A majority of contributors concurred that the level of spending on health care, particularly when compared to the health outcomes achieved, is enormously wasteful.

A majority of contributors expressed agreement that cuts in certain areas may be appropriate.

Notably, one of the two members who argued that massive inefficiencies in government spending exist also argued that, while there are public spending categories that can be pruned, a reduction in total U.S. public spending is undesirable. Rather, the participant argued that tax revenues will have to increase.

No member took spending cuts off the table. However, there was significant debate over what, how much, and when cuts should take place.

One member noted that, while spending cuts are always politically difficult, in the present populist age, sharp spending cuts are all the more politically challenging.

It was also noted that an emergency scenario could arise which forces austerity - a situation we should very much seek to avoid.

- - - - - - -

The “Exorbitant Burden”

Members expressed concern that the current administration views the ‘exorbitant privilege’ of the U.S. dollar’s role as the global reserve currency as an ‘exorbitant burden’.

A majority of participants noted that long-run indicators suggest the USD could lose its status as the global reserve currency, but when and how remain unclear.

Multiple participants expressed concern that, if we see a decline in the global role of the USD over the next few decades, the FG will find itself facing fiscal constraints it currently does not.

However, it was noted that there is currently no viable alternative to the U.S. dollar as the global reserve currency, which prevents the dollar from losing its dominant position near-term.

- - - - - - -

Could A Policy Mistake Trigger a Crisis?

There was a unanimous consensus that a policy mistake by the FG could trigger a crisis in the Treasury market and expose underlying fragility in the FG’s fiscal position.

It was also noted that these risks are difficult for markets to price in.

Two members brought up the possibility that mishandling the FG debt ceiling could trigger a bond market crisis.

One member noted that, as fragility grows, an exogenous shock may not even be required to trigger a FG fiscal crisis.

- - - - - - -

The Debt Ceiling

There was a unanimous consensus that the debt ceiling should be abolished.

Multiple contributors described the brinksmanship around the debt ceiling as ‘dangerous political theater’. Two members brought up the possibility that mishandling the debt ceiling could trigger a bond market crisis.

It was also noted that the debt ceiling: 1) has failed to stop the FG debt from rising, 2) was not created with that purpose in mind, and 3) is not a better alternative to the fiscal discipline which, theoretically, should be imposed by the bond market.

The graph below shows the debt ceiling rising repeatedly since 1980, in tandem with the growing FG debt.

Moreover, the debt ceiling and FG debt have risen regardless of which political party is in the White House.

- - - - - - -

Public Net Worth

One participant argued that the relevant metric when assessing the FG’s fiscal position is not the debt/GDP ratio, but rather the government’s net worth. That is, what matters is the government’s liabilities relative to its assets. This approach assesses the fiscal soundness of the FG the way we might evaluate the financial soundness of a private sector enterprise.

The participant noted that, if we evaluate the FG by taking a comprehensive view of its liabilities relative to its assets, its fiscal position is actually worse than the debt/GDP figure would suggest.

The FG debt to GDP is currently above 100%. And simple metrics suggest the FG had $28 trillion in debt at the end of Q3 2024.

But if we take a balance sheet perspective and include the roughly $15 trillion of projected federal employee and veteran benefits liabilities which are not accounted for in the $28 trillion figure, we find that the FG’s true liabilities stand at north of $40 trillion. In other words, the public debt to GDP figures underestimate the severity of the fiscal situation.

Meanwhile, the FG's assets only add up to $5.6 trillion.

So the true net worth position of the FG is significantly worse than its debt position alone indicates.

The participant noted that many FG assets are mis- or under-valued. Therefore, the true value of the FG’s assets might be higher than $5.6 trillion. For example the U.S. Department of War does not report the value of its real estate.

It was suggested that, if these public assets were managed properly, they could yield non-tax returns to the Treasury and reduce the amount by which taxes will need to be increased or spending decreased.

A counter-note was advanced that taking a balance sheet approach to the FG may risk overlooking characteristics of the FG which are unique to it and not applicable to private sector enterprises, such as the FG’s ability to issue its own currency or increase immigration to expand the tax base. It was also noted that the U.S. has no effective current account constraint, a feature unique to its case.

- - - - - - -

Timing of A Sovereign Debt Crisis?

Participants could not determine with confidence when high FG debt levels might result in a U.S. sovereign debt crisis.

The case study of Japan was noted in reference to the difficulty of determining how and when debt crises might play out: its central government carries the world’s highest debt/GDP ratio, but this has not yet resulted in a crisis.

One contributor expressed an expectation of debt monetization, a loss of federal reserve independence, and a higher rate of inflation, rather than an outright default.

- - - - - - -

Raising The Retirement Age

Given the increase in ‘health expectancies’ America has experienced over the last few decades, all members were open to the possibility of raising the ages at which workers qualify for federal retirement benefits as part of the series of initiatives to address the FG fiscal shortfall.

One member recommended a differentiated system of retirement ages under which workers in physically demanding professions (e.g. coal mining) would have an earlier retirement age than those in less physically strenuous roles.

Another member suggested that the retirement age be uniform across industries with the expectation that people can change jobs as they age out of more physically strenuous jobs.

Participants agreed that these changes could be grandfathered in incrementally.

- - - - - - -

The ‘Government As Household’ Analogy

Participants were asked whether they believe the ‘government as household’ analogy is useful.

Two members view the analogy as having issues but being potentially useful in the public discourse. They argue that it can help simplify what could otherwise be a complex conversation about things like credit spreads and yield curves. It can also help with understanding the need to focus on the quality of expenditures.

One member argued that it can be helpful if used well, but is unlikely to be used appropriately, and so it’s better for policy-makers to avoid it.

Three members said the analogy is not helpful and should be discarded by policy-makers. One of these three members argued that, rather than using analogies, the emphasis should be on education, with politicians educating the public on the policy tradeoffs they face and the public, in turn, educating the politicians on the decisions they’d like to see taken.

Thus, a four to two majority of members recommend that policy-makers avoid using the 'government as household' analogy.

- - - - - - -

Demography

All contributors expressed concern about how demographic changes will affect the fiscal position of the country - though it is difficult to determine exactly how.

The example of Japan was given as a case study in the complexity of determining how demographic decline may affect the FG fiscal position.

On the one hand, a declining population without immigration shrinks the labor market causing, all else equal, wages/costs to go up and thereby resulting in inflation.

On the other hand, older people spend less and save more, which tends, all else equal, to subdue inflation.

So declining fertility produces countervailing tendencies, making it difficult to predict exactly what its impact on the FG fiscal position and other economic variables may be.

——————

Written By: Aiden Singh

Published: January 6, 2026